Potential home buyers are in short supply right now, as the November numbers for pending home sales were down and the economy continues to throw out turmoil, causing purchases to be put on hold and markets and exchange traded funds (ETFs) to waver.

Buyers are just delaying their purchases, as the unstable economy has caused the lowest level on record to be recorded last November, 2008. Alan Zibel for the Associated Press reports that the index, which tracks signed contracts to purchase existing homes, fell 4% to 82.3 from a downwardly revised October reading of 85.7 in October. Economists were anticipating a reading of 88.

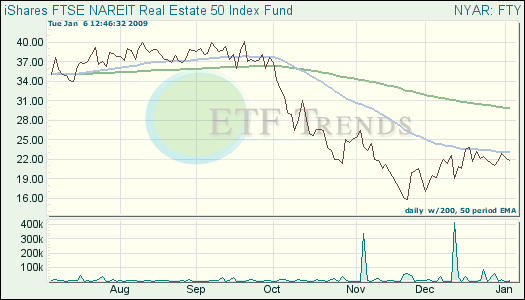

- iShares FTSE NAREIT Real Estate 50 (FTY): down 30.9% over past three months

November also bottomed for factory orders, as the numbers dropped in this month for the fourth month in a row. Manufacturing is set to have a tough year, as the global economy slows and weakness is seen among auto, steel and defense communications equipment, reports Martin Crutsinger for the Associated Press.

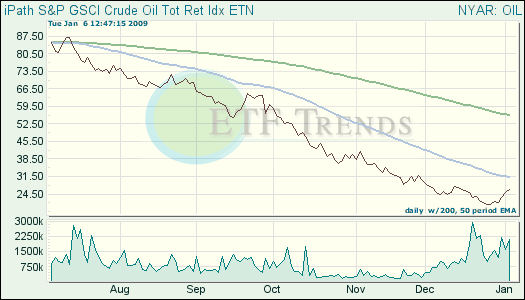

Tuesday is a good day for the United States stock markets, as they opened higher than usual, thanks to crude oil prices rising back above $50 per barrel. The price settled just below this. David Jolly and Jack Healy for The New York Times report that oil prices plunged from their summer peaks of $145 a barrel as the economic downturn spread, but they have rebounded from their lows as motorists took advantage of lower gasoline prices.

- iPath S&P GSCI Crude Oil Total Return Index ETN (OIL): down 52.4% over past three months

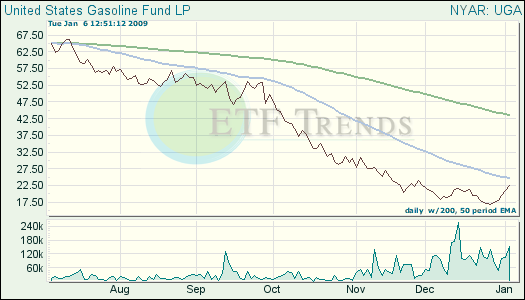

The downward slide in gas prices everyone was enjoying came to a halt in this month, though, as gasoline prices have crept up a couple cents per day, because of some indicators that the national average could go to $2 by spring. Clifford Krause for The New York Times reports that the latest trend in oil have taken oil prices up 40% per barrel. OPEC cartel cuts may be having their way upon the pricing.

If gas prices continue to rise, consumers may be in for a tougher-than-anticipated year if job security remains loose and home values and investments continue to weaken.

- United States Gasoline (UGA): down 49.4% over the past three months

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.