There is no good news on the homebuilder front for related stocks and exchange traded funds (ETFs), as the sales of new homes plunged to the slowest pace in more than two decades. The downward pressure on builders is weighing on the sector as whole.

The Commerce Department reported that the new home sales fell 14.7% in December to a seasonally adjusted annual rate of 331,000, down from 388,000 projected in November. Alan Zibel for the Associated Press reports that this is the slowest pace since 1963 and builders have slashed production, but not fast enough.

- SPDR S&P Homebuilders (XHB): down 7.5% over past three months; D.R. Horton Inc. 4.7%; Centex Corp. 4.5%

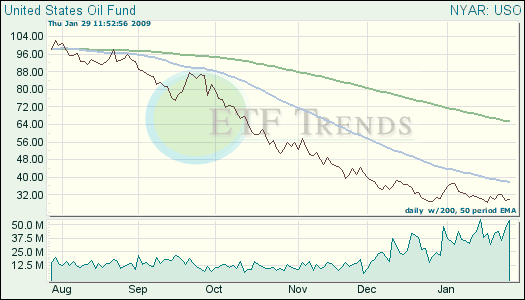

As of Thursday, oil prices have dropped as the housing market continues to plunge, and job losses are infecting the nation. Orders for the larger ticket manufactured goods have practically frozen and the worst annual sales are posted in over two decades. Chris Kahn for the Associated Press reports that overall, the recession has cut into energy spending by businesses and consumers, taking prices near five year lows.

Light, sweet crude for March delivery fell $1.12 to $41.04 a barrel on the New York Mercantile Exchange.

- United States Oil (USO): down 44% over past three months

Unemployment is mounting and the number of people seeking jobless benefits is reaching an all-time high, and the layoffs are not even half way finished. 4.78 million people are out of work and seeking unemployment benefits, the highest since 1967, reports Christopher S. Rugaber for Associated Press.

Economists missed the mark at 4.65 million, and this is the highest number of people seeking out these benefits since 1983, amidst another deep recession. Major businesses are continuing layoffs.

- Ford Motor Company (F) lost $14.6 billion last year, and they are the only Detroit automaker not being held up by millions in injected capital. Nick Bunkley for The New York Times reports that the company 2008 with $24 billion in cash on hand but $25.8 billion in debt.

- Eastman Kodak Co. (EK) is eliminating 4,500 jobs and is restructuring, with shares down 24%, reports Meg Tirrell for Bloomberg.

President Barack Obama won House approval on an $819 billion economic stimulus plan, the biggest one in history, without a single Republican vote. Tax cuts and spending can’t seem to meet both parties’ needs at this time. All but 11 Democrats voted for the plan, and 177 Republicans voted against it, reports Jackie Calmes for The New York Times.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.