Germany may be headed for a wash of unemployment, giving markets and exchange traded funds (ETFs) a grim outlook for 2009.

One leading economist in Germany anticipates 700,000 job losses in their country for the year 2009, as the economy is set to shrink by 2%-2.7% within the year. This is a total reversal within the labor market, as 2008 proved to have immunity to some of the letdown experienced from the credit crunch. The Local reports that the most likely indicator will fall back this year, in what may prove to be a protracted recession.

The European Union has approved two measures that will help German firms affected by the financial crisis. Yan for China View says the first measure is a $20.4 billion plan that will give liquidity to undertakings affected by the current credit squeeze. It will give interest rate reductions and provide loans for finance investments. The second measure, a Federal framework scheme, allows economic policy actors at Federal, regional, and local levels to provide aid to firms in need.

German leaders met today to talk about a second stimulus package, as well. The initial package of $42.1 billion had been criticized as being too modest, Reuters reports. Any new measures agreed upon today won’t be finalized until at least Jan. 12.

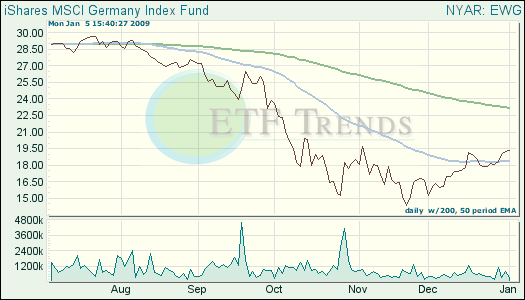

- iShares MSCI Germany Index (EWG): up 20.8% in the last month

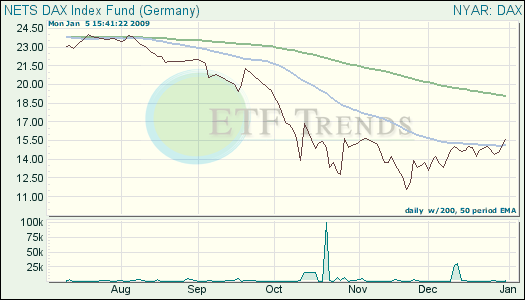

- NETS DAX Index (DAX): up 16.6% in the last month

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.