California is home to the world’s eighth-largest economy, but the state is also leading the biggest budget crisis with out a deficit to fall back on, causing despair for related bonds and exchange traded funds (ETFs).

The gap between projected revenues and spending during this fiscal year and next amounts to $41.6 billion, which is almost half the total sum that the state expects to raise next year, reports The Economist. According to Gov. Arnold Schwarzenegger, the budget crisis will include wide-ranging budget cuts especially to those non-viable schools, and punishing tax increases. The sales tax would raise 1.5% until 2012. The budget assumes that infrastructure spending will increase, that firefighting costs will be half of what they spent this year and that the state will be able to sell $5 billion in bonds by July.

Let’s hope this all falls into place, because what if it does not? Congress finds this plan distasteful, as cuts to health care and education should not be feasible. So far, the plan will face much opposition in the State capital.

- iShares S&P California Muni Bond Fund (CMF): up 2.2% year-to-date and a 3.6% yield

For the first time in four years, the state budgets in 20 states are coming up short and 35-40 states could face cuts in 2009, according to Justin Ewers on U.S. News & World Report. Other states, among many more, that are facing a budget crisis right now:

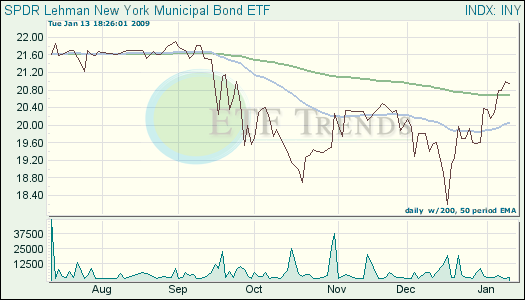

New York is another struggling state. Access to muni bonds there can be had through the SPDR Lehman New York Municipal Bond (INY), which is up 2.8% so far this year and has a 4.2% yield.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.