The bleak economic news that came out in 2008 saw a number of companies scaling back their dividends, if not eliminating them altogether. However, in the big picture, relatively few companies actually cut dividends and just three companies were responsible for the majority of that: Citigroup (C), Bank of America (BAC) and Wachovia (WB).

WisdomTree’s Director of Research Jeremy Schwartz points out that at the time of their annual index reconstruction on Nov. 30, there were 1,200 dividend payers paying out $267 billion. While that’s down from the $288 billion paid out at the same time in 2007, the three financials above were responsible for $20 billion of the $21 billion difference.

Their domestic funds pay quarterly, and the international funds will also begin paying quarterly this year. Until now, they were paying annually.

WisdomTree went with the dividend strategy because, Siracusano says, “We realized the world didn’t need another market-cap weighted index fund. We use this strategy because there’s a lot of research that told us it was better.”

Three funds to take notice of are:

- WisdomTree Total Dividend (DTD): This fund gives exposure to all dividend-paying stocks in the United States. It had a yield of 4.4% at the end of 2008, and distributed 0.39 cents a share in the December quarter.

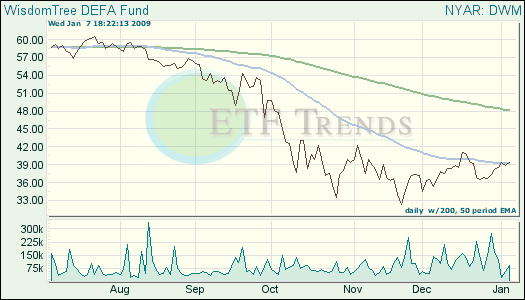

- WisdomTree DEFA (DWM): Tracks the WisdomTree Dividend Index of Europe, Far East Asia and Australasio (DEFA). As noted above, it distributed $1.76 a share in December for a 4.6% yield.

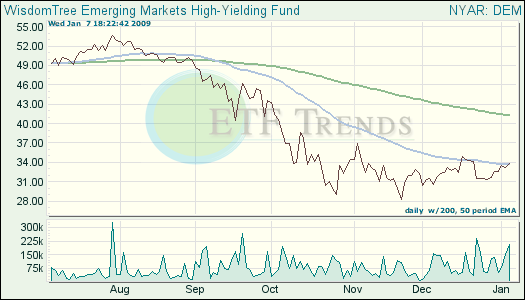

- WisdomTree Emerging Markets High-Yielding Equity (DEM): Had a yield of 6% at the end of December. Siracusano says that while cap-weighted indexes were down as much as 58%, DEM was down 37% for 2008.