The world’s largest gold exchange traded fund (ETF) is one of the winners of 2008, in terms of total holdings.

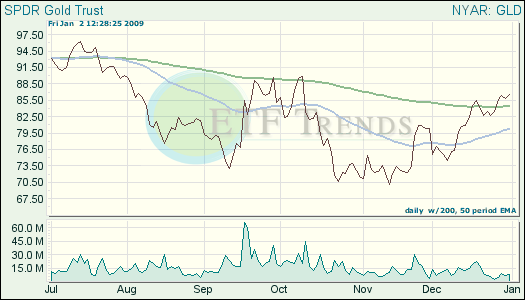

Allen Sorka for The Wall Street Journal reports that the world’s largest gold ETF has been on a roller coaster ride in 2008 that had it ending the year near a peak. In July, SPDR Gold Shares (GLD) ETF held 705.90 metric tons, backed off in September, and then rose again as markets went haywire. As of Dec. 17, the fund showed record holdings of 775.33 tons, signifying a 23.5% increase from the end of 2007. A rising ETF holding is indicative of support for a commodity because actual physical demand is created.

ETFs are a great investment tool to access gold because there is no actual physical gold to deliver and there are no minimums for account size like the futures markets have. Also, investors can dodge the leverage and margin requirements that futures markets entail.

If market turmoil continues this year, gold might continue to look good to investors. Experts differ on what, exactly, gold will be doing in the coming months and years.

- SPDR Gold Shares (GLD): up 4.2% for 2008

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.