The lights are on but nobody’s there, as commercial real estate vacancy rates continue to rise, exchange traded funds (ETFs) tracking this narrow sub-sector look to be benefiting from what investors could be seeing as a buying opportunity.

Office building vacancy rates now exceed 10% in almost every major city in the United States, and this number will continue to rise as the economic distress plays on. This problem will also affect the lending crisis, and take property values down with it. The forecast for more job cuts, and businesses retracting is going to create more empty office space from New York, to Chicago to Los Angeles, reports Chrales V. Bagli for The New York Times.

Thus far banks have not had problems with commercial property owners like they have had with residential homeowners. Many building owners, while struggling with more vacancies and less rental income, will need to refinance commercial mortgages this year. Lending is already difficult as of right now and credit markets are not cooperative for refinancing, even for those who are current on their payments.

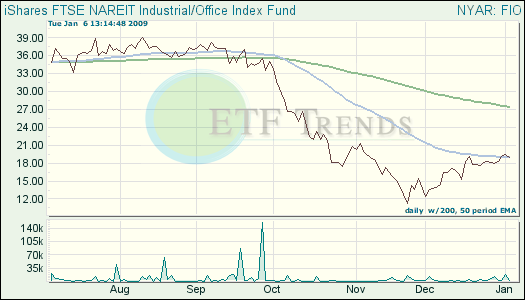

Note that this fund is hovering around its 50-day moving average, and is up in midday trading. We’re watching and waiting on a market rebound, and investors need to watch out for ETF opportunities that present themselves.

- iShares FTSE NAREIT Industrial/Office Index (FIO): up 1.41% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.