Municipal bond exchange traded funds (ETFs) have been around long enough to prove their merit through performance. It also appears that muni bond ETFs are better for long-term investors seeking expsure to fixed income.

Jo Eqcome for Seeking Alpha points out that 41 out of 50 states are reporting budgeting shortfalls for the year 2009, with prospects of bankruptcy looming. Muni bond ETFs are poised to do well, for the following reasons:

- Fixed-income markets are on the mend, thanks to improving credit markets

- A Federal stimulus package would support the muni bond market, as the new Presdidency takes action

- Investment characteristics such as discounts to NAVs and spreads to Treasuries

- Year-end tax selling may cause a “bounce”

The muni ETF have lower management fees than the closed end fund (CEFs) and use little leverage, among other differences. They offer a conservative approach to long-term investing within the muni bond market.

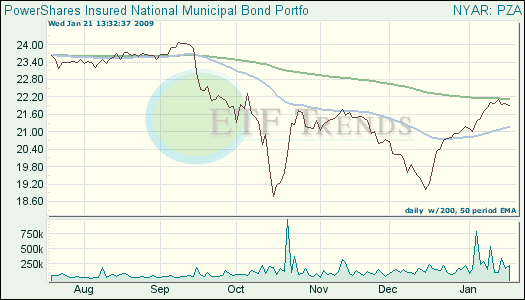

- PowerShares Insured National Muni Bond Fund (PZA): down 9.8% for one year

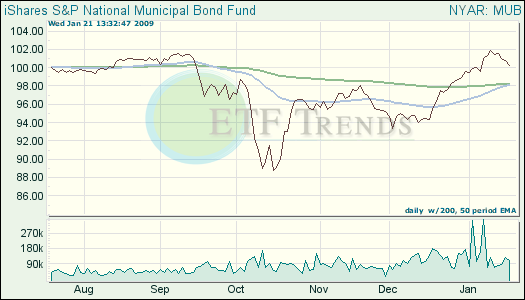

- iShares S&P National Muni Bond Fund (MUB): up 1.7% for one year

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.