Although many economies are set to contract in 2009, Austria is one that is expected to survive the drop without much damage to their economy or exchange traded fund (ETF).

The Austrian economy is set to contract up to 0.5%-1.0% in 2009, which will not be a catastrophe, according to a member of the European Central Bank Governing Council.

Member Ewald Nowotny says that it’s more of a “quasi-crisis,” even though this type of shrinkage has never been seen in Austria, according to Sylvia Westall for Reuters.

The contraction means to expect job market shrinkage, decreased investment activity, and difficulty for some companies. Austrian research institute WIFO said in December it expects growth to slow by 0.1%-0.5% in 2009 and the government has put in place a $135 billion banking package in the face of the financial crisis.

Austria has a number of factors working in its favor in the long run, including:

- A well-developed m,arket economy and a high standard of living

- Strong commercial relations, particularly in banking and insurance

- A large service sector

To prevent a downturn from worsening, the country will need to continue restructuring and putting more emphasis on knowledge-based sectors, according to the CIA World Factbook.

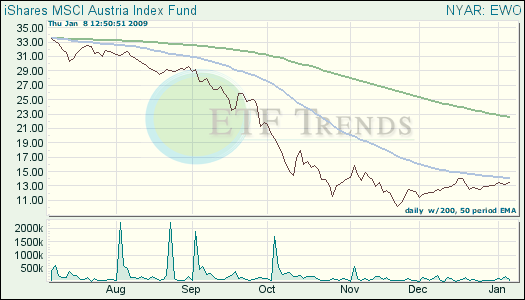

- iShares MSCI Austria Investable Market Index (EWO): Yesterday, it was one of the few ETFs that closed higher, up 2.4%; it’s down 19.6% over three months, and 4% below the 50 day-moving-average; Erste Grp Bank, 13.3% of EWO.

Moody’s may lower their Erste Group Bank ratings from Aa3 long-term debt and deposit ratings to C, on concern over financial flexibility. Wal-Street says that the bank may not be able to withstand the expected weakening of their main markets in Central and Eastern Europe, and may require further capital injection measures over the next few years.

Meanwhile, Erste Bank has taken over Weinviertel Savings Bank, with a take over of 99% of the bank, and the deal will be sealed as of February 2009. New Europe says the price has not been unveiled and a 1% interest will remain in the hands of the savings bank’s private foundation. This move would fortify Weinviertel Bank and not affect any current customers.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.