The Japanese yen is showing signs of weakening this morning, but it might actually be good for the Asian economy’s exchange traded fund (ETF).

Japanese investors may soon be on the hunt for higher-yielding currencies, as the yen fell against the U.S. dollar, euro, the Aussie dollar and the New Zealand dollar. It appears the yen is weakening on sentiment for equities, and the auto bailout deal has driven that decline; South Korea’s won had its largest gain in six months, reports Stanley White for Bloomberg.

Japan’s economy is coming upon hearder times these days, with manufacturing slumping and consumer confidence hitting lows. A weaker yen could help matters, as a strengthening yen has impacted Japan’s exports, because it makes their stuff more pricey. This could be contributing to their pain, as domestic spending will be slower than usual. Manufacturers are planning the biggest job cuts in 35 years. Japan is simply too entangled in the global markets to not be affected by the downturn.

The yen’s decline today also indicates more positive investor sentiment as a deal on the U.S. auto bailout nears, and the yen generally tends to rise when investors start going toward safety assets.

The Japanese Finance Ministry is watching the yen closely and is ready to stem radical currency moves for monetary policy, in order to stave off any bleeding.

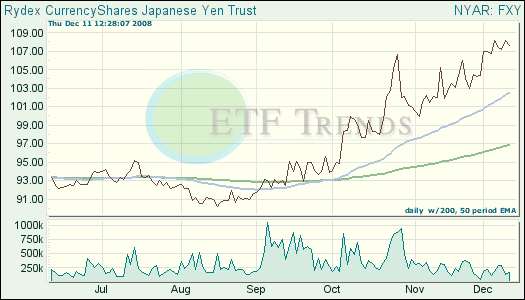

- CurrencyShares Japanese Yen Trust (FXY): up 20.1% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.