Deep rate cuts here and around the world have enticed investors to hoard precious metals and their respective exchange traded funds (ETFs) for an impending risk of hyperinflation.

Common sense suggests that the increased liquidity and consumer spending will cause inflation, which would then lead investors the relative safety of precious metals, writes Gary Gordon for ETF Expert.

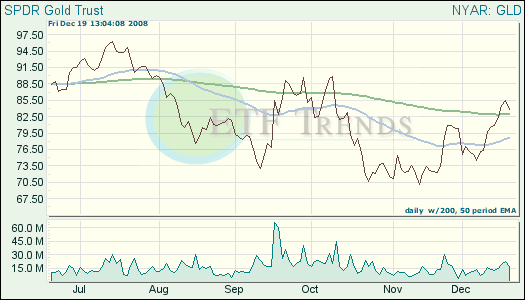

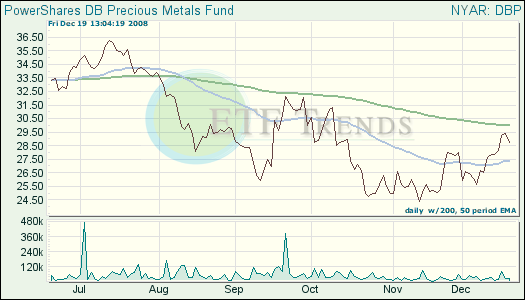

Precious metal ETFs such as streetTracks Gold Shares (GLD) is 15.6% off its high but up 1.8% year-to-date, it is essentially flat for the year. PowerShares DB Precious Metals Fund (DBP) is down 6.4% year-to-date but it is noted that the ETF is up 7.59% for its 50-day moving average.

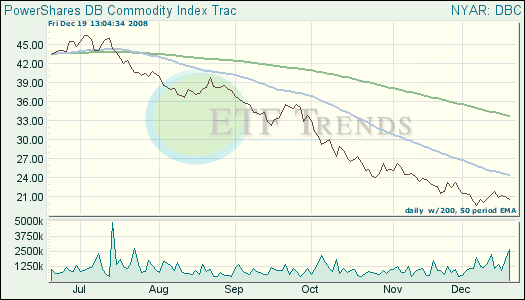

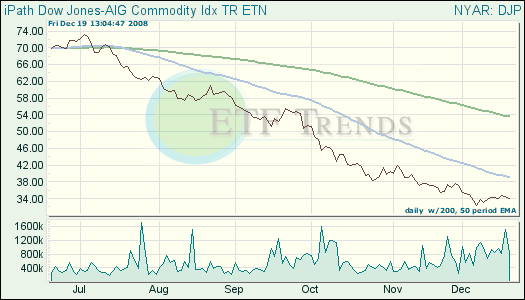

The upward trends of precious metals do not reflect the trends of other commodity ETFs, such as the PowerShares Commodity Index Tracking Fund (DBC) and the Dow Jones AIG Commodity Index ETN (DJP) which are down 34.6% year-to-date and 39.5% year-to-date respectively, that have given way under current pressures of deflation.

It just shows that precious metals, a staple for inflationary times, are doing quite well in a deflationary period. But it is noted that this paradox is because of lagging indicators of deflationary data where investors are simply amassing precious metals for what may be a lucrative golden future.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.