China is encouraging airlines in their country to cancel or delay jet orders, which probably won’t encourage any positive performance in aerospace exchange traded funds (ETFs).

Travel demand is down, among other things, and as the world’s second-largest aircraft market, the government has asked that China park unnecessary planes, retire old ones and return aircraft leased from overseas once the contracts are up, according to the Civil Aviation Administration of China (CAAC). Bloomberg says that China is going to do away with jet fuel taxes and refund some facility fees in an effort to help carriers.

Companies like Airbus and Boeing depend on emerging markets like China to offset low demand in the United States and Europe, so this is getting them where it really hurts.

Parallel to the downsizing in China is the delay of the 787 test flight by Boeing (BA) in the United States. The aerospace developer has put the much anticipated test flight of the 787 on hold due tot he recent strike impact and production problems, says Daniel Lovering for Associated Press.

The delay was the latest in a series of setbacks for the 787, which has been touted for its expected high fuel efficiency because of its construction from lightweight carbon fiber composite parts.

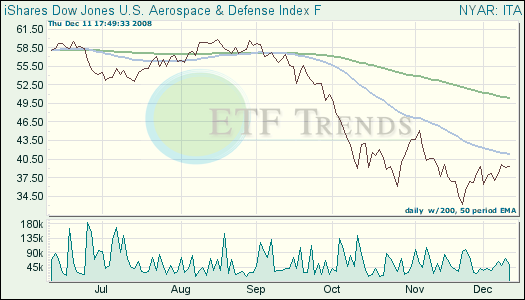

- iShares Dow Jones U.S. Aerospace & Defense (ITA): down 45.3% year-to-date; Boeing is 8.4%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.