Despite crude oil output cuts from OPEC and a growing conflict between Israel and Palestinian militants, oil prices and exchange traded funds (ETFs) are fluctuating, but ultimately flat so far today.

So far, analysts were expecting light trading volume for the years’ close and prices for light sweet crude have fluctuated as much as 7%, reports John Porretto for the Associated Press. Light, sweet crude for February delivery rose 31 cents to $38.02 a barrel on the New York Mercantile Exchange, which will be closed Thursday for the New Year’s Day holiday.

So far, prices per gallon at the pump have remained lower for the consumer, around $1.60 nationwide.

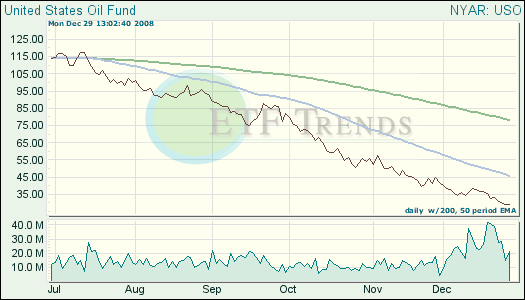

United States Oil (USO) is down 61.6% year-to-date.

GMAC, the financing arm for General Motors (GM), has kept silent as to whether or not bondholders had an approved plan for the bailout. The midnight Dec. 26 deadline has passed, and access to federal funds was contigent on the loan provider completing a debt-for-equity exchange, reports Leslie Wayne for The New York Times.

The company is trying to become a bank holding company, which would enable them to apply for bailout financing from the Federal governments bank rescue fund and take out short term loans from the Federal Reserve.

The total tally of the emergency bankruptcy filings from Lehman Brothers has been reported, with as much as $75 billion in potential value for creditors lost. According to Jeffery McCracken for The Wall Street Journal, it is too early to say how much money Lehman creditors could recover; the bond market projects a recovery of about $20 billion.

Had the filing been orderly and planned, the bank would have had time to sell assets outside of bankruptcy court protection and has time to unwind derivatives positions, giving the landing less of an impact.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.