By now, all investors should know that China is a growing force in the global economy, but the question at hand is how does an investor play the Chinese market with exchange traded funds (ETFs) to satisfy his or her appetite? ETFs that track the emerging markets are plentiful and can be broken down into the general categories of direct exposure, BRICs exposure, and mixed exposure, states Richard Kang of Index Universe.

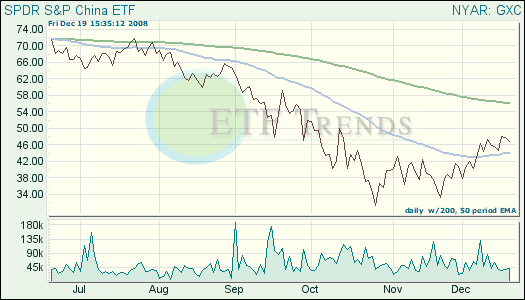

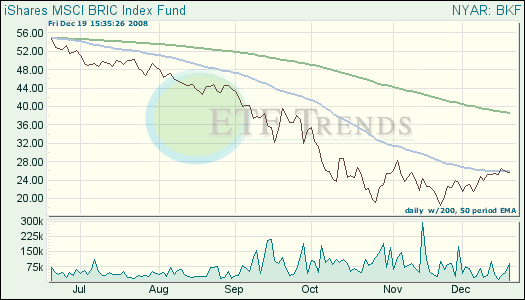

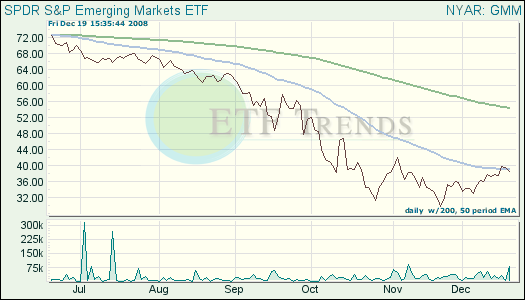

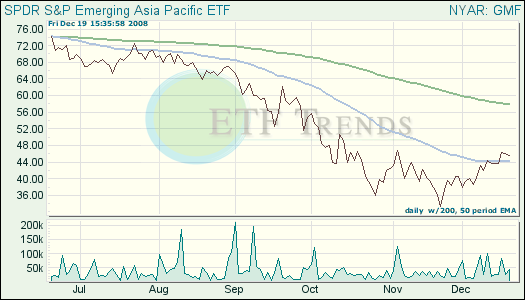

An example of a direct exposure ETF is the SPDR S&P China (GXC), which is down 47.8% year-to-date; a BRIC exposure ETF is iShares MSCI BRIC (BKF), which is down 56.8% year-to-date; a mixed exposure ETF is SPDR S&P Emerging Markets (GMM), which is down 49.8% year-to-date. Investors can also gain indirect exposure to China through Asia Pacific funds like the SPDR S&P Emerging Asia Pacific ETF (GMF), which is down 47.8% year-to-date.

Note that GMF and GXC and have crossed above their short-term 50-day moving averages, while GMM and BKF are hovering near that key point.

With all of these choices, investors must really take the time to consider just how exposed to China they want to be, whether to consider emerging markets as core or non-core holdings in their portfolios, and the optimal balance between the focus on return enhancement versus risk reduction.

Lastly, this last year’s market performance has indicated that moving away from the classic theory of diversification based on a mix of relatively uncorrelated positions results in having all your eggs in one basket.

Research has indicated that when diversifying away from developed markets to emerging markets investors may actually be anit-diversifying, focusing on return enhancement rather than risk exposure. Additionally, when investing in emerging markets, like China, it should be long term because of China’s dependency on the decoupling theory of the economy from the western world and this theory further trickling down to the emerging markets-this trend takes time to play in.

It is all dependent on an investor’s goals, but the vast array of exposure to Chinese markets allows them to pick and choose which ETFs will support their investment styles.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.