Employment within mining and construction equipment making will be hit hard, as weakening global demand has forced companies in this sector to downsize, further weakening related investments such as exchange traded funds (ETFs).

Caterpillar Inc. (CAT) reported they are cutting executive compensation by 50% next year because of anemic demand, not just domestically, but overseas as well. The top pay for senior managers will be cut by 5-35% while other management and support staff are to be cut up to 15%, reports Associated Press on The New York Times.

Along with this comes a hiring freeze, reductions within incentive programs and equity-based compensation. Layoffs, factory shutdowns and incentives for voluntary leave are also on the agenda. These are all symptoms of the overall weak demand.

Just a few months ago, global economic demand was making up for U.S. weakness, as record-breaking demand is now a figment of the past. China’s sales were expected to top $2 billion, and global sales were projected to be at least $50 billion. Countries such as China, India, Southeast Asia and the Middle East are no longer booming in their building cycle.

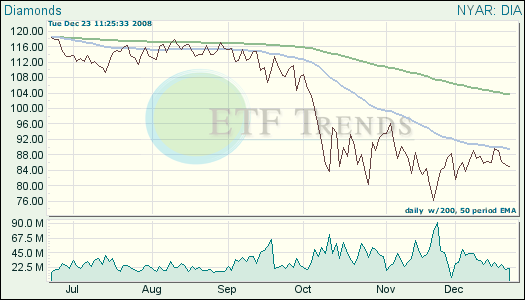

- DIAMONDS Trust, Series 1 (DIA): down 34.3% year-to-date; Caterpillar is 4.6%

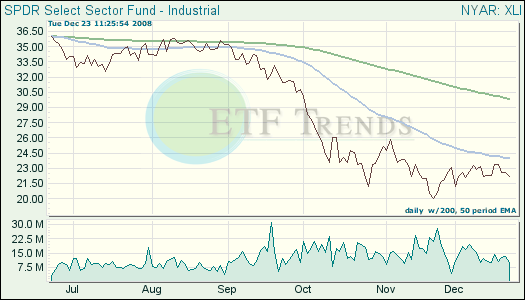

- Industrial Select Sector SPDR (XLI): down 42.4% year-to-date; Caterpillar is 3.5%

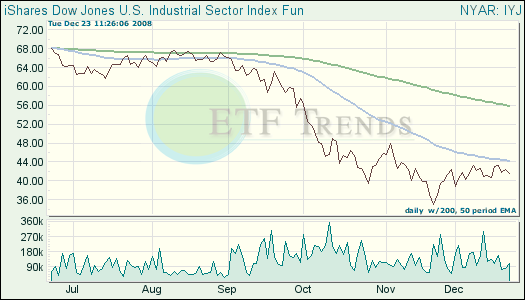

- iShares Dow Jones U.S. Industrial (IYJ): down 42.2% year-to-date; Caterpillar is 2.5%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.