Thailand’s economy is no stranger to rising prices that affect the economy and its exchange traded fund (ETF). For that reason, the central bank raised its benchmark interest rate for the first time in two years.

Inflation is rising the fastest it has in a decade, and the bank cautioned that more increases were possible, says Suttinee Yuvejwattana for Bloomberg. The rate is now at 3.5%.

The baht also fell on concern that the increase wasn’t going to be enough to do the trick and cool the inflation rate, which hit 8.9% last month. The rising cost of food and oil have been forcing central banks from Vietnam to Pakistan to raise borrowing costs, despite a slowdown in the United States that has cooled demand for Asian exports.

Thailand’s key stock index slid for three straight days, losing 3.4% today.

As part of an effort to help the nation’s poor, Thailand’s prime minister announced a $1.4 billion program to cut fuel taxes, offer free electricity and water and waive fares for bus and train seats.

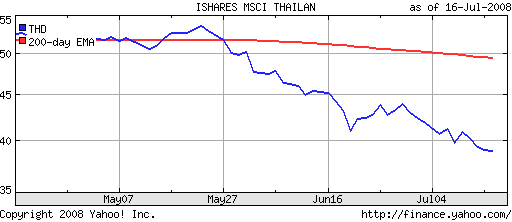

The iShares MSCI Thailand Investable Market Index (THD) seems to reflect the ailing state of the country’s economy these days, as it’s down 25% since its April 1inception. Will the rate cuts be enough?

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.