As water systems across the country and throughout the world become more of an issue every day, many exchange traded tunds (ETFs) could potentially take advantage of this growing problem.

Updates for water systems are estimated to exceed $250 billion in costs over the next 20 years in the United States alone. However, with these sort of upgrades essential throughout the world, water infrastructure is quickly emerging as a market for investors.

Steve Henn for Marketplace notes that as water and water infrastructure quickly become a very big business, private equity investors and major corporations have taken notice. Executive director of the International Private Water Association, Kathy Sandling was quoted as saying, “What we are talking about is trillions of dollars.” Her group feels as though the only way to bring clean water to the masses is through private investment.

With the water and water infrastructure issue looming in the United States, it has found its way into discussions among Congress. Legislators are currently discussing a second economic stimulus bill that could include almost $15 billion in infrastructure spending. Despite water lurking in the shadows of oil prices, water and water infrastructure are becoming more prevelant as both a national and international issue, report Lisa Lambert, John Crawley and Richard Cowan for Reuters. As more money flows into mending water systems globally, ETFs could reap the benefits.

Funds that cover this area are:

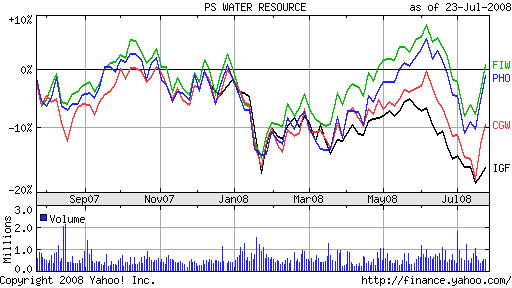

- PowerShares Water Resources Fund (PHO), up 0.4% year-to-date

- Claymore S&P Global Water (CGW), down 8.4% year-to-date

- First Trust ISE Water (FIW), up 0.7% year-to-date

- iShares S&P Global Infrastructure (IGF), down 13.3% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.