One of the areas that has demonstrated strength during this economic downturn is consumer spending on necessities, which might be benefiting the Wal-Mart supplier exchange traded fund (ETF).

Any strength shown among consumer spending in recent months has mostly been attributed to spending and discount retailers, such as Wal-Mart (WMT), Costco (COST) and Target (TGT). In fact, the most recent figures that showed a 4.3% jump in retail sales last month, it was Wal-Mart and Costco that reaped the rewards.

Sales at Wal-Mart last month were up 5.8% for stores open a year or more. The retailer also said it expected its second-quarter profit to be higher than it had forecast.

But are the suppliers benefiting, too?

The FocusShares ISE-Revere Wal-Mart Supplier (WSI) has a diversified set of mostly familiar brand names in its top 10 holdings, including:

- Church & Dwight Co. (CHD): 4.9% of holdings; maker of cleaning and deodorizing products such as Arm & Hammer Baking soda, cat litter, toothpaste and laundry detergents.

- Clorox (CLX): 4.8% of holdings; maker of cleaning products, stain removers and other home-care products.

- General Mills (GIS): 6.2% of holdings; maker of cereals, yogurt, soups and snacks.

According to the Associated Press, Clorox is projected fiscal fourth-quarter results above analyst estimates. Those results are expected on Aug. 1. In the same quarter last year, the company reported revenue of $1.34 billion. This year, they are expecting about $1.47 to $1.49 billion.

General Mills hasn’t been faring so well – strange because you’d think most people would choose food over bleach. But the prices for ingredients are cutting into profits, reports Joshua Freed for the Associated Press. The company reported last month that its fourth-quarter profit had fallen 17%, in line with expectations.

Church & Dwight this week said they expect to either meet or exceed quarterly profit expectations, reports the Associated Press. Those numbers will be delivered on Aug. 4.

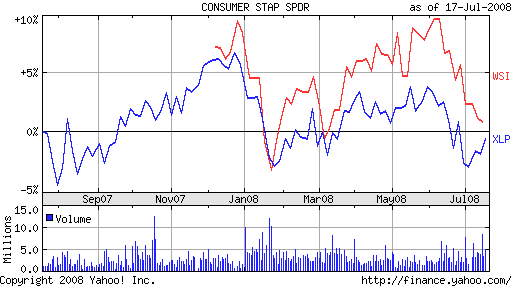

Year-to-date, WSI is down 3.5%, and it’s slightly outpacing the Consumer Staples Select Sector SDPR (XLP). XLP doesn’t count any of the above companies as a top holding, but Wal-Mart is 10.7% of it.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.