Short-term gold prices are forecasted to to go up by UBS Bank, as the financial market trauma thickens, and the related exchange traded funds (ETFs) strengthen. Gold is one of the places that investors feel the safest, causing the investment bank to see prices for gold average $1,000 per ounce over the next month, reports Jan Harvey for Reuters.

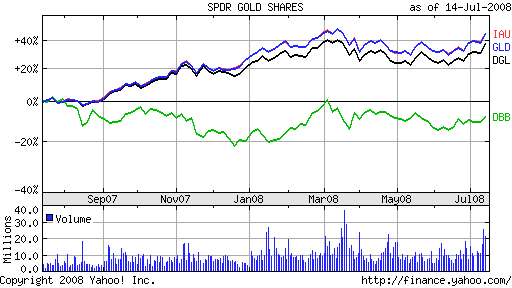

Much fear has spread since Fannie Mae and Freddie Mac, the heaviest U.S. mortgage finance companies, have fallen into major distress. As of late, gold rallied to $967.70 per ounce, especially as equity markets slid and the dollar went weaker. Holdings of the largest gold ETF, the SPDR Gold Trust (GLD), also rose. The fund is up 16.3% year-to-date.

ETF Securities said yesterday that the amount of silver and platinum held by their exchange traded commodities (ETCs) fell back, while gold and palladium holdings went higher, says Harvey.

Other ETFs that could be affected if UBS’s forecasts prove true:

- iShares Comex Gold Trust (IAU), up 16.6% year-to-date

- PowerShares DB Base Metals (DBB), up 15.8% year-to-date

- PowerShares DB Gold (DGL), up 14.6% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.