Life-cycle exchange traded funds (ETFs) have joined up with life-cycle or target-date mutual funds to offer retirement savings for investors, the closest thing that many ETFs have gotten toward inclusion in retirement packages.

The same theory applies: as the life-cycle fund portfolio invests into other mutual funds, life-cycle ETFs invest in other ETFs. Life-cycle ETFs also invest into individual stocks and bonds, used in combination with ETFs to reach the desired asset allocation, reports Lisa Smith for Investopedia.

A life-cycle ETF operates under the same asset allocation formula that assumes the investor will retire at a specific, pre-determined date, which is identified in the title of the fund. The portfolio’s asset allocation should become more conservative over time. The automatic re-balancing that occurs serves as a form of active management, so that the portfolio’s actions stay in line with the objective.

While these funds can also be used to achieve other goals, too, such as getting married or going to college, they’re most commonly marketed toward investors thinking about reitrement.

Some life-cycle ETFs are:

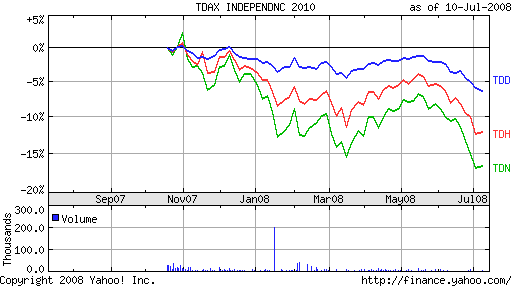

- TDAX Independence 2010 ETF (TDD), down 3.3% year-to-date

- TDAX Independence 2020 ETF (TDH), down 9.4% year-to-date

- TDAX Independence 2030 ETF (TDN), down 12.9% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.