Growth in the wireless sector has telecommunications exchange traded funds (ETFs) ringing up good numbers today.

AT&T (T) announced today that its quarterly profit had gone up even more than expected, reports Ritsuko Ando for Reuters. The growth among its wireless subscribers compensated for the loss in traditional landlines. Analysts said they were still worried about that, as well as growth in the number of high-speed internet subscribers in the second quarter, which was weaker than expected.

AT&T gets a boost from its relationship with Apple (AAPL), as the exclusive U.S. carrier for the iPhone.

Another cell phone market player, however, hasn’t fared so well. Yesterday, Vodaphone (VOD) reported a disastrous second quarter, and its share price dropped 14% as a result, reports Stephen Beard for Marketplace. That prompted the company to buy back $2 billion of its stock to restore confidence.

The company was hit worst in Spain, where the collapse of the property market has left many people out of work, prompting them to leave the country and the Vodaphone network.

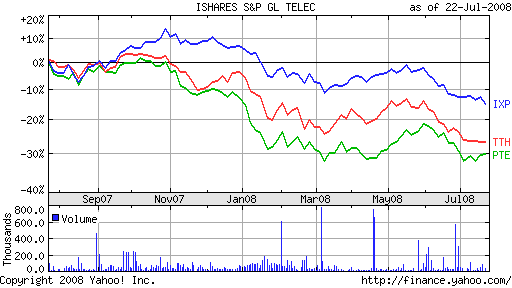

ETFs potentially affected:

- iShares S&P Global Telecommunications (IXP): down 18% year-to-date; AT&T is 15.7% year-to-date; Vodafone is 12.4%

- Telecom HOLDRs (TTH): down 22.7% year-to-date; AT&T is 58.5%

- PowerShares Dynamic Telecom& Wireless (PTE): down 18.8% year-to-date; AT&T is 5.1%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.