For successful economic development, Turkish officials should look up to Sweden as an example of successful privatization, which could boost the performance of both countries’ respective exchange traded funds (ETFs).

Benefits of privatization include producing more wealth for everyone, such as workers, employees and businessmen. Ishak Alaton for the Swedish-Turkish Business Council says such moves could help companies in Turkey function as vibrant motors of the economy.

The biggest misconception of socialism is that the Turkish believe that it equals state ownership, reports Reeta Paakkinen for Turkish Daily News.

Alaton is first turning his attention to natural resources. In 2005, forests in Turkey accounted for 9% of all land. In order to protect those forests and make use of their wealth, they should be privatized.

Barack Obama is traveling to Europe, and the continent is eager to demonstrate the successes that have come from their market-based reforms, says Henry Olsen for the Wall Street Journal. In the 1990s, Sweden put into place pension reforms that included a private account option. In this, workers can set aside 2.5% of their income into one or more of nearly 800 private sector accounts.

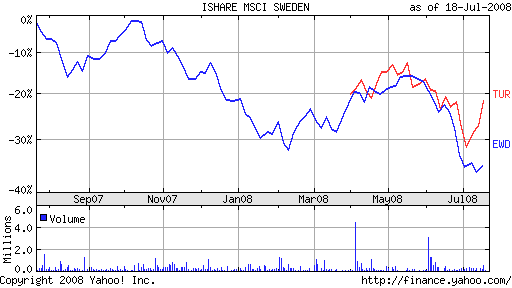

iShares MSCI Sweden Index (EWD) should give some insight into the country’s wealth and accomplishment through a socialist society. Industrial materials and financial services make up the top assets, however, much of the ETF is spread evenly throughout other holdings such as consumer and business services, telecommunication and hardware. It’s down 13.1% year-to-date, but its five-year annualized returns are 20.7%.

Instead of having a money-losing state-owned enterprise, Turkish government should recognize the need for a privatized economy to increase the potential for everybody’s wealth, and in turn, the nation. If Turkey were to embrace and implement these changes based on Sweden’s example, iShares MSCI Turkey Fund (TUR) would see a turn around as well. The fund launched on April 1, and since then, it’s unchanged.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.