An 11.2% drop-off in oil prices last week, coupled with big one-week losses in some oil-related exchange traded funds (ETFs) has suddenly got analysts wondering if the bubble is bursting.

We know consumers are eager to spend a little less on gas and other fuels, but is it really time to declare the bubble burst? Most experts say not so fast, reports Adam Schreck for the Associated Press. One analyst says it’s too early to call that we’ve seen the worst of it.

Oil closed at $128.88 a barrel last week. The average price for gas also fell slightly, to $4.105.

Commodities can be unpredictable, so we think that sticking to your plan is the wisest choice here. If you got in on oil’s run-up earlier this year, protect your profits and exit when your holdings drop 8% off their high.

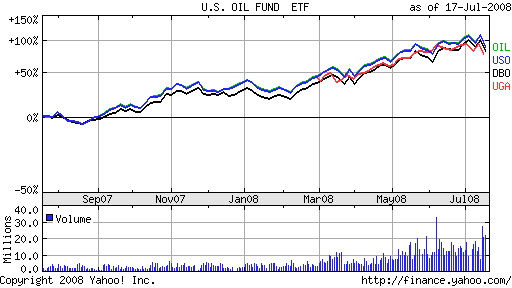

- United States Oil (USO), up 37.8% year-to-date

- United States Gasoline (UGA), up 18.4% since Feb. 28 inception

- iPath S&P GSCI Cruide Oil (OIL), up 39% year-to-date

- PowerShares DB Oil (DBO), up 43.1% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.