The Securities and Exchange Commission (SEC) is taking aim at illegal short sellers, but it might have little impact on exchange traded funds (ETFs).

The practice of short-selling is all well and good, but “naked” short-selling is another matter altogether, and it’s not as saucy as it sounds.

Instead, it involves shorting what you don’t have, reports Tom Petruno for the LA Times blog. In typical short-selling, investors bet on falling prices by borrowing shares. In naked short-selling, no arrangement has been made to borrow shares, and it’s illegal.

The problem has gotten special attention in the wake of the financial crisis, since the SEC suspects that some of the short sellers are singling out financial stocks by engaging in naked sort-selling while spreading rumors that companies are in dire straits, with the collapse of Bear Stears as Exhibit A.

But the SEC’s crackdown is raising questions of how free the markets are here from interference by the U.S. government. By restricting people’s ability to invest on negative information, the long-term health of the market could be affected, says a securities-law professor.

Short-sellers say in their defense that they prevent stocks from becoming overvalued and are an essential feature of the market.

The impact on ETFs should be minimal, as they use derivatives to short their funds instead of the actual stocks. Short ETFs get their exposure in several ways:

- By buying securities that make up the given index, in the same proportion that they’re in the index

- Buy futures contracts on the S&P

- Swap agreements with counterparties

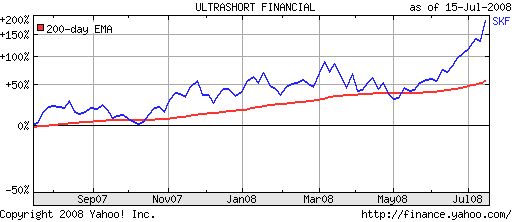

Short financial ETFs are down sharply in early trading. The ProShares UltraShort Financials (SKF) has been down by as much as 10.5% this morning. It’s up 104.7% year-to-date The ProShares Short Financials (SEF) is down, as well. It launched on June 12.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.