Mexico’s peso is at a five-year high, and it could be just the thing to make the currency’s exchange traded fund (ETF) shout, “Ole!” The CurrencyShares Mexican Peso Trust (FXM) closed yesterday at an all-time high. It’s up 6.6% year-to-date.

The rise was attributed to the gain in U.S. stocks as well as bets that the Federal Reserve will hold off on raising interest rates once again when it meets next month, reports Valerie Rota for Bloomberg.

Food and housing prices in Mexico have pushed the country’s inflation rate to its highest level in three and a half years. This has led to speculation that Mexico’s central bankers will raise interest rates for the second straight month when they meet tomorrow.

One expert predicts that the peso will continue to strengthen, finishing out a 9.95 per dollar by the end of this year. It touched 10.2255 yesterday. He also predicts that the central bank will raise key lending rates to 8.5% this year.

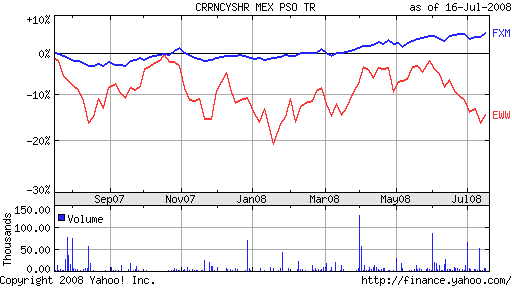

The peso’s performance against the dollar in the last year:

The iShares MSCI Mexico (EWW), down 1.6% year-to-date, could benefit from a strengthened currency and economy, as well.

Read the disclosure, as Tom Lydon is a board member of Rydex Funds.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.