Last week’s drop in oil prices led to money shifting away from energy-related exchange traded funds (ETFs).

And, of all places, investors appear to be putting it into financials.

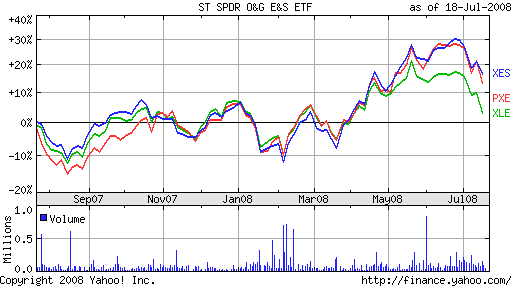

As crude oil fell below $130 a barrel on Friday, the Energy Select Sector SPDRs (XLE) tumbled to a four-month low, reports Trang Ho for Investor’s Business Daily. XLE is down 2.8% year-to-date. One expert suggests that investors turn an eye to oil exploration funds instead, which aren’t as highly pegged to the price of oil.

Two such funds are the PowerShares Dynamic Energy Exploration & Production (PXE), which is up 2.9% year-to-date, and SPDR S&P Oil & Gas Equipment & Services (XES), which is up 12.4% year-to-date. While XLE is 100% allocated in energy, XES and PXE are mostly in energy with a little industrial materials and/or consumer services thrown in, as well.

Oil is off to a volatile start for this week. In early trading, prices rose more than $3 on worries about Iran’s nuclear program, as well as a storm in the Gulf of Mexico. They then pulled back to below $130, reports Peter Graff for Reuters.

It’s hurricane season, which might cause some volatile movements in the next few months as storms threaten various oil fields.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.