The fond memories you have for your college diet might deliver an energy boost to consumer staples exchange traded funds (ETFs).

Kraft Foods (KFT) reported its second-quarter earnings, which rose 4%, reports Emily Fredrix for the Associated Press. Could higher food prices being sending consumers back to their old college day low-cost standbys?

Kraft doesn’t just make the famous macaroni and cheese in the blue box, but also Velveeta, Oreo cookies and Maxwell House coffee. Their earnings reports beat analyst expectations, thanks in large part to the company’s swift action when it came to rising prices. Many of their competitors lagged behind them when it came to charging a bit more to offset rising costs.

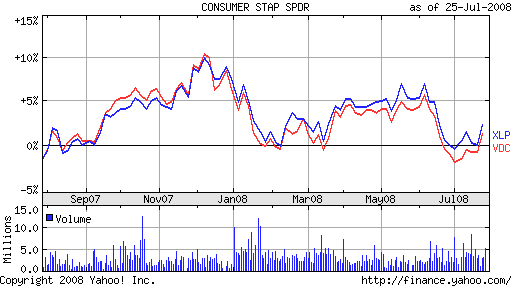

The Vanguard Consumer Staples (VDC) is up slightly in trading today, and it’s down 5.9% year-to-date. Kraft is 3.6% of the fund. It’s also 3.9% of the Consumer Staples Select Sector SPDR (XLP), which is down 5.6% year-to-date.

Verizon (VZ) also reported higher profits today, because of wireless sales that were strong enough to offset any losses among landline users. Executives went on to say that they didn’t expect a significant impact from the weakening economy, reports Ritsuko Ando for Reuters. Second-quarter revenue rose 3.7%, in line with expectations.

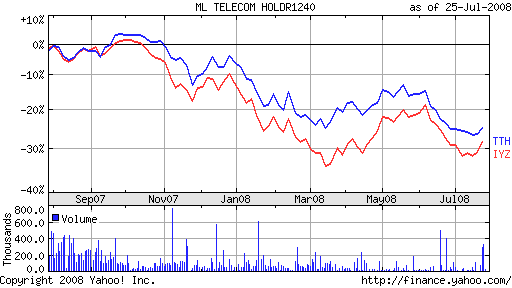

There are still nerves about a labor dispute, as the union’s labor contact is set to expire on Aug. 2. Verizon’s shares are trading lower today, and it’s weighing down a few ETFs that count it as a top component:

- iShares Dow Jones US Telecom (IYZ): down 20.5% year-to-date; Verizon is 15.4%

- Telecom HOLDRs (TTH): down 23.6% year-to-date; Verizon is 24.3%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.