The latest trends in consumer spending are important for exchange traded fund(ETF) investors to understand, and give insight into the lucrative areas of the market.

Where better to look than to MasterCard, for information concerning consumer spending? Their latest study was done based on Asian e-commerce trends, reports Tony Sagami for Money And Markets. Asia’s latest Internet growth shows some convincing points that are of interest to investors:

- Asia e-commerce is subject to a 23% growth a year for the next decade.

- China will replace Japan as the largest online shopping market by the year 2010.

- MasterCard expects 480 million Chinese to spend $1.4 trillion over the Internet, followed by India.

According to Sagami, the latest big winner, based on the above information, would be the China Mobile (CHL) stock. Chinese consumers are more willing to buy a mobile phone rather than a PC, and these phones are used for traditional calling services, caller ID, call forwarding, voice mail, conference calling, instant and text messaging and Internet access.

ETFs that can help access the company:

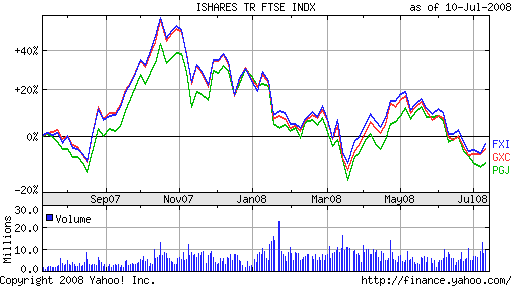

- iShares FTSE/Xinhua China 25 Index (FXI): down 22% year-to-date; 8.7% in China Mobile

- SPDR S&P China (GXC): down 24.2% year-to-date; 15.4% in China Mobile

- PowerShares Golden Dragon Halter USX China (PGJ): down 28.8% year-to-date; 6.1% in China Mobile

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.