Oil exchange traded funds (ETFs) might be taking a breather today, but that doesn’t mean black gold’s relentless rise is over just yet.

The price has more than doubled in the last year, and David Landis for Kiplinger’s says another 44% rise is not exactly unthinkable. One analyst who accurately forecast triple-digit prices several years ago says oil will hit $200 a barrel within the next couple of years.

Or…oil is a bubble that’s about to burst. You make the call! Trying to figure out in the short-term what’s going to happen is just speculation, but the argument can be made that the long-term trend is up.

Today in trading, however, oil has fallen below $142, reports Alex Lawler for Reuters. On top of a strengthening U.S. dollar, which hit a one-week high against major currencies, investors are also watching Iran in its dispute with the West over its nuclear work. Iran is the world’s fourth-largest oil exporter.

Will energy and oil continue to fall back and free up our spending cash once again? Or will we wake up tomorrow to news of new highs? ETFs give investors the opportunity to hedge the growing cost of gas, oil and everything else. Among the energy-focused funds available are:

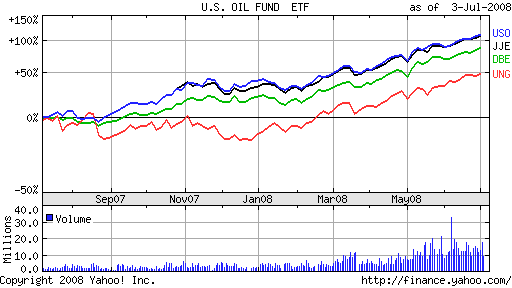

- United States Oil (USO), up 54.2% year-to-date

- United States Natural Gas (UNG), up 74.7% year-to-date

- PowerShares DB Energy (DBE), up 59.4% year-to-date

- iPath Dow Jones-AIG Energy Index Total Return Sub-Index ETN (JJE), up 59.8% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.