There are vast, untapped reserves of oil and natural gas in the Arctic, and if those resources are tapped, it could impact related exchange traded funds (ETFs) down the line.

An estimated 90 billion barrels of oil and one-third of the world’s undiscovered natural gas are beneath the Arctic Circle, which government scientists discovered in the largest-ever survey of the area’s energy resources. The region includes parts of the United States, Russia and Canada, reports the Associated Press.

Today’s current consumption is about 86 million barrels a day, meaning the untapped oil could last for three years.

Oil prices have been heading south lately, but they’ve been struggling today to post a rally while gasoline prices continued to head lower. Gas is down to $4.026 a gallon, while oil rose to $124.56, reports Adam Schreck for the Associated Press. Natural gas futures are at $9.788 per 10,000 million British thermal unites.

Americans have been cutting their consumption in recent weeks, using 2.4% less fuel in the last four weeks than they did last year.

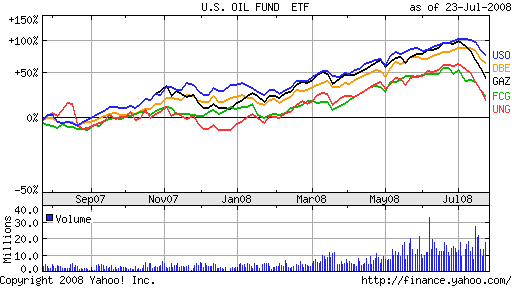

It’s been a volatile and interesting year so far for fuel, and it’s sure going to be interesting to see what happens in the second half of 2008. ETFs to watch:

- United States Oil (USO): down 9.7% in the last month; up 32.2% year-to-date

- United States Natural Gas (UNG): down 27.5% in the last month; up 25.7% year-to-date

- First Trust ISE-Revere Natural Gas (FCG): down 22.6% in the last month; up 12% year-to-date

- iPath DJ AIG Natural Gas Trust Sub-Index (GAZ): down 27.2% in the last month; up 25.6% year-to-date

- PowerShares DB Energy (DBE): down 9% in the last month; up 36.6% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.