Cloned animal products are at the center of many concerns among food regulators from the European Union, which could ultimately have an impact on agriculture exchange traded funds (ETFs).

These regulators are considering the use of cloned food products in European markets. Food cloning could develop into a rather substantial industry if it is supported by European consumers. With the United States backing the use of cloning to produce meat and milk products, it will be interesting to see what kind of stance is taken by the EU.

Many circumstances circling the cloning issue are discussed by BobMoon and Stephen Beard for Marketplace Public Radio. They are quick to point out further clarification is needed to resolve the cloning issue at hand, especially with regard to the safety of cloned animal products. One of the more important issues, they say, is the health and welfare of the clones and their surrogate mothers.

European consumers are described as squeamish and fussy in this discussion. Moon and Beard highlight that the European consumers have yet to accept genetically modified crops, let alone cloned animal products. These consumers, however, could face the reality of cloned animal products sooner than later, as European governments and food producers feel cloned animals produce leaner and more tender meat and increase milk yields.

Despite the reluctance of the European consumer, there are some factors that Maureen Groppe of USA Today points out that may justify the production of cloned animal products. In her article, she discusses the soaring food prices in the US, which have risen 7.5% since last year. The rise in food prices are considered to be directly correlated with high oil prices and the weak dollar.

As this problem looms in the United States, food shortages around the globe could justify the use of cloned food products as well. The Food and Agricultural Organization estimates that nearly 40 countries are facing food shortages that require international intervention.

With different factors surrounding the issue of cloned animal products, many different agriculture ETFs could benefit from investment in this developing industry. Some agriculture ETFs include:

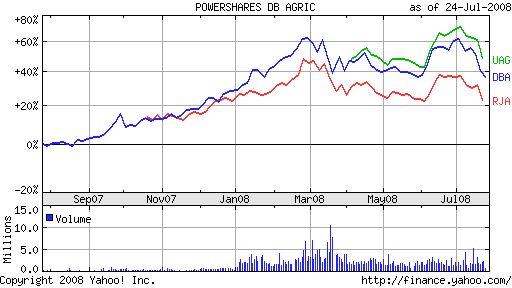

- PowerShares DB Agriculture (DBA), up 7.6% year-to-date

- ELEMENTS Rogers Intl Commodity Agriculture (RJA), down .6% year-to-date

- E-TRACS UBS Bloomberg CMCI Agriculture (UAG), launched on April 1, 2008

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.