Financial-related exchange traded funds (ETFs) surged today after Federal Reserve Chairman Ben Bernanke said Fannie Mae and Freddie Mac were in no danger of failing.

It was his second day of testimony about the state of the ailing U.S. economy. It was less downbeat than yesterday’s testimony. Bernanke said the two mortgage giants, which hold or guarantee more than $5 trillion in mortgages, were adequately capitalized, reports Jeannine Aversa for the Associated Press.

The rescue plan seemed to rattle nerves, but the intent was to signal to investors around the world that the government is prepared to do whatever it takes to keep the credit crisis from engulfing the financial markets.

Shares for Wells Fargo (WFC) delivered a shot of good news today, reporting a profit drop that was not as big as had been expected. Its quarterly dividend was up by 10%, as well, reports Madlen Read for the Associated Press. Many other financial institutions are slashing their dividends in order to preserve capital.

The San Francisco-based bank has weathered the storm better than its rivals, partially because it didn’t have as much exposure to subprime mortgages.

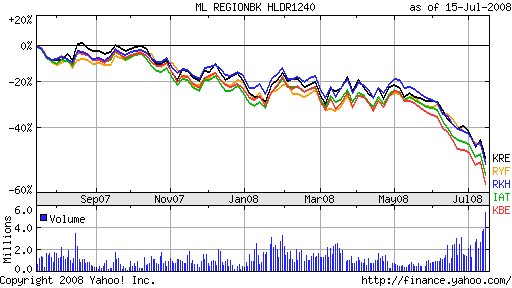

Bernanke’s assurances and Wells Fargo’s numbers combined to make unleveraged financial ETFs the superstars in today’s markets, including:

- Regional Bank HOLDRs (RKH): down 42.3% year-to-date; Wells Fargo is 13.7%

- KBW Bank (KBE): down 43.7% year-to-date; Wells Fargo is 9.3%

- iShares Dow Jones U.S. Regional Banks (IAT): down 39.3% year-to-date

- KBW Regional Bank (KRE): down 38.1% year-to-date

- Rydex S&P Equal Weight Financial (RYF): down 37.7% year-to-date; Wells Fargo is 13.7%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.