The Federal Open Market Committee is in the midst of a two-day meeting to discuss their next moves on monetary policy, which will include a policy decision announcement set to take place on Wednesday.

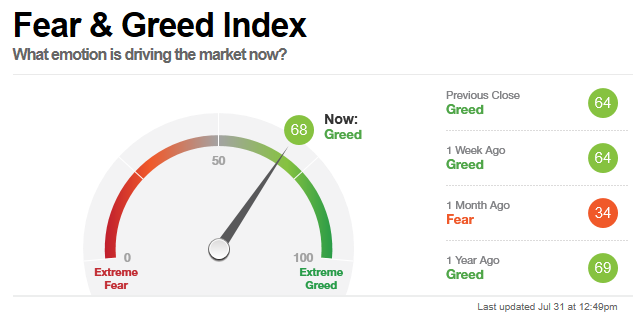

The latest data from the Department of Commerce shows that gross domestic product rose 4.1% in June, which will weigh heavily on the minds of the FOMC with respect to determining monetary policy. With this latest figure regarding GDP, the economic sentiment seems to corroborate with the data as it has entered into greed territory based on the CNN Money’s Fear & Greed Index, which measures the emotions driving the markets.

The bond markets will certainly be wary of what the FOMC will announce and fixed-income investors should keep an eye on these ten fixed-income ETFs ahead of the policy decision.

The bond markets will certainly be wary of what the FOMC will announce and fixed-income investors should keep an eye on these ten fixed-income ETFs ahead of the policy decision.

Related: An ETF That Taps Into Closed-End Funds for High Yields

1. Vanguard Interm-Term Corp Bd ETF (NASDAQ: VCIT)

With the market uncertainty ahead of the policy decision, fixed-income investors should hold investment-grade debt if they plan to approach the bond markets with a long-term view. VCIT seeks to track the performance of a market-weighted corporate bond index with an intermediate-term dollar-weighted average maturity, namely the Bloomberg Barclays U.S. 5-10 Year Corporate Bond Index. While VCIT holds debt issues with maturities between 5 and 10 years, they are all investment-grade holdings to minimize default risk.

2. iShares 1-3 Year Credit Bond ETF (NASDAQ: CSJ)

For fixed-income investors with a short-term horizon, CSJ is a viable option. CSJ tracks the investment results of the Bloomberg Barclays U.S. 1-3 Year Credit Bond Index so CSJ will invest at least 90% of its assets in investment-grade corporate debt and sovereign, supranational, local authority and non-U.S. agency bonds that are U.S. dollar-denominated. CSJ invests in debt issues with a remaining maturity of greater than one year and less than or equal to three years to minimize credit risk.

3. SPDR Blmbg Barclays Inv Grd Flt Rt ETF (NYSEArca: FLRN)

A floating rate component will be beneficial if the FOMC makes a hawkish policy decision on Wednesday. FLRN seeks to provide investment results that correlate with the price and yield performance of the Bloomberg Barclays U.S. Dollar Floating Rate Note < 5 Years Index. Like SHYG, FLRN limits duration exposure with investments in debt securities with maturities that don’t exceed five years. In addition, at least 80% of its assets will be allocated towards securities comprising the index, such as U.S. dollar-denominated, investment grade floating rate notes. The floating rate allows investors to capitalize on any short-term interest rate adjustments in accordance with monetary policy.

4. ProShares High Yield—Interest Rate Hdgd (BATS: HYHG)

HYHG tracks the performance of the Citi High Yield (Treasury Rate-Hedged) Index and allocates 80% of its total assets in high-yield bonds and short positions in Treasury Securities in order hedge against rising rates. Because HYHG invests in high-yield bonds, there is credit risk associated with the higher yield since the fund invests in corporate issues that are less than investment-grade. By targeting a duration of zero, HYHG offers less interest rate sensitivity versus its short-term bond peers.

5. iShares 0-5 Year High Yield Corp Bd ETF (NYSEArca: SHYG)

SHYG seeks to track the investment results of the Markit iBoxx® USD Liquid High Yield 0-5 Index composed of U.S. dollar-denominated, high yield corporate bonds with maturities of less than five years–the shorter durations help to decrease exposure, helping to mitigate credit risk. SHYG invests at least 90% of its total assets in the component securities of the index, primarily high yield corporate debt, and may invest up to 10% of its assets in certain futures, options and swap contracts, cash and cash equivalents.

6. iShares iBoxx $ High Yield Corp Bd ETF (NYSEArca: HYG)

For investors who are willing to take on more risk in order to attain higher yields, HYG tracks the investment results of the Markit iBoxx® USD Liquid High Yield Index, which is comprised of high yield U.S. corporate bonds that have less than investment-grade quality. Investors who have been able to stomach the credit risk have seen total returns of 3.95% the last three years and 1.22% the past year based on Yahoo! Finance performance figures.

7. Vanguard Short-Term Corporate Bond ETF (NASDAQ: VCSH)

VCSH tracks the performance of the Bloomberg Barclays U.S. 1-5 Year Corporate Bond Index–a market-weighted corporate bond index with a short-term dollar-weighted average maturity. In addition to VCSH allocating capital towards debt issues that are investment-grade, fixed-income investors will like the reduced exposure to duration with maturities between 1 and 5 years.

8. SPDR Blmbg BarclaysST HY Bd ETF (NYSEArca: SJNK)

For risk-hungry investors, junk bonds are worth a look for a high-yield component to a fixed-income portfolio. SJNK seeks to provide investment results that correspond generally to the price and yield performance of the Bloomberg Barclays US High Yield 350mn Cash Pay 0-5 Yr 2% Capped Index. SJNK invests its total assets in the securities comprising the index, which is designed to measure the performance of short-term publicly issued U.S. dollar-denominated high yield corporate bonds. The short-term maturities will help hedge some credit risk due to the lesser exposure, but holdings are still less than investment-grade. SJNK has returned 1.20% year-to-date, 2.94% the past year and 3.76% the last three years.

9. SPDR Portfolio Short Term Corp Bd ETF (NYSEArca: SPSB)

SPSB seeks investment results that correlate with the Bloomberg Barclays U.S. 1-3 Year Corporate Bond Index, which is designed to measure the performance of the short term U.S. corporate bond market. Like VCSH and CSJ, SPSB focuses on investment-grade holdings with short durations to hedge against credit risk. Based on Yahoo! Finance, SPSB has been able to generate a 1.28% return for investors within the last three years.

10. iShares iBoxx $ Invmt Grade Corp Bd ETF (NYSEArca: LQD)

LQD seeks to track the investment results of the Markit iBoxx® USD Liquid Investment Grade Index composed of U.S. dollar-denominated, investment-grade corporate bonds. LQD allocates 95 percent of its total assets in investment-grade corporate bonds to mitigate credit risk.

For more trends in fixed income, visit the Fixed Income Channel.