ETF Trends caught up with Nancy Davis, CIO and Managing Partner at Quadratic Capital Management and manager of the Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL), to discuss the Fed, inflation and opportunities in today’s market.

The Fed has changed its take on inflation towards an average. Which assets could benefit from such a move?

Nancy Davis: The market has taken the Fed at its word and expects that rates are going to stay low for a long time. The Fed seems set to keep rates low even after inflation moves towards, and probably even beyond, their 2% target. In the short term, that could be positive for equities. Similarly, a dovish Fed willing to let inflation run hot could be positive for Inflation protected securities (TIPS). Rising rates could happen because of unexpected inflation. The large support from both monetary and fiscal policy could eventually trigger higher inflation.

With the Fed willing to accept higher inflation, TIPS should outperform nominal bonds. Currently, inflation breakevens are priced at a discount compared to the last 10y average. (5y BE = 1.51% vs. 10y average of 1.72%). TIPS look attractive, especially with the Fed aiming for a 2% symmetrical inflation target . Nominal bonds currently offer little upside vs significant downside potential. For example, the 10y bond could be up about 7% if yields go to zero but could lose more than double that if yields go back to 3%.

Do you think CPI is a good representation of inflation in the current world?

Nancy Davis: Not for investors. The Bureau of Labor Statistics, which runs the CPI calculation says that it, “measures inflation as experienced by consumers in their day-to-day expenses.” – (Consumer Price Index Frequently Asked Questions : U.S. Bureau of Labor Statistics).

About 1/3 of CPI is defined by “shelter,” and that is mostly rent. Rent and shelter might not be the most important factors for investors.

IVOL enhances it’s TIPS portfolio with options as a way to own inflation expectations. Our interest rate options offer exposure to the steepness of the yield curve. They are similar to options on inflation expectations, since the yield curve is largely a result of inflation expectations. Thus, the options have the potential to increase in value with a normalization of inflation expectations. This gives IVOL investors another way potentially to profit from inflation factors that are not in the CPI basket, and may move securities’ prices more substantially.

Where do you see opportunities in today’s market?

Nancy Davis: The fixed income market is not offering a lot of opportunities. Nominal Treasuries are all risk with very little reward. Take, for example, the 5 year currently yielding 26 bps. IG credit and mortgages can be put in the same camp. Extending duration gains you almost nothing with the yield curve so flat. One only picks up meaningful yield by hunting in the HY and private space, but with the attendant credit and liquidity risk. There’s a reason you get the yield pickup.

I believe that IVOL offers good value in this market. Inflation expectations are very low as investors expect that the pandemic will be deflationary and interest rate volatility measured by the MOVE index just hit an all-time low since 1988. There aren’t a lot of things out there that investors can buy now at all-time lows.

IVOL is a first-of-its-kind fixed income ETF that seeks to hedge relative interest rate movements, whether these movements arise from falling short-term interest rates or rising long-term interest rates, and to benefit from market stress when fixed income volatility increases, while providing the potential for enhanced, inflation-protected income.

What are the benefits of using options?

Nancy Davis: Using options allows investors to set up naturally asymmetric positions with limited downsides and unlimited upsides. We actively manage the IVOL options portfolio to extract the value from market moves and to keep the portfolio positioned for the most asymmetrical opportunities.

It is a challenging environment for investors. We understand why. If they own short-duration Treasuries, they are getting paid historically low yields while waiting for rates to rise. If they own longer duration Treasuries, they fear that rates may rise and hurt the mark-to-market of their bonds. Other investors have moved on to TIPS, despite the low yields. We think Treasury holders of all stripes are right to worry. IVOL may help each type of Treasury investor, but in different ways:

Short-duration Treasuries – Many owners of short-duration Treasuries hold these bonds because they are concerned about higher rates and are trying to limit their duration risk exposure. But even short-duration bonds have duration risk, so these investors are only mitigating their risk. They may want to consider if an allocation to IVOL may suit their needs better. IVOL may help as a potential hedge during bond market selloffs while simultaneously providing potentially enhanced distributions.

Long-duration Treasuries – Investors who hold longer-dated Treasuries may want to consider IVOL as a hedge. We believe that the risk/reward of owning longer dated Treasuries with rates at these levels is “all risk, no reward.” Holders of these types of Treasuries could face steep mark-to-market losses on these bonds. IVOL may work as a hedge for these investors because the very things that might decimate a portfolio of long-dated Treasuries (higher rates, higher volatility, increasing inflation) might cause IVOL to increase in value. Meanwhile, IVOL holders have received monthly distributions of at least 30 bps since it began to pay distributions in July 2019.

Treasury Inflation-Protected Securities (TIPS) – IVOL is an inflation protected strategy that captures inflation expectations. It does more than capturing only CPI inflation (like a TIPS portfolio). About 1/3 of CPI is defined by “shelter,” and that is mostly rent. Rent and shelter might not be important items that investors could be trying to protect against. We believe that enhancing our TIPS portfolio with options gives us a way to own inflation expectations. Our interest rate options offer exposure to the steepness of the yield curve and therefore are similar to options on inflation expectations, because the yield curve is largely a result of inflation expectations. Thus, our options have the potential to increase in value with a normalization of inflation expectations. As such, IVOL gives investors another way potentially to profit from inflation items that are not in the CPI basket.

Going forward, where do you see diversification? Are bonds going to continue to be diversify equity risk?

Nancy Davis: Bonds historically have had a negative correlation with equities and many investors tend to have a 60/40 portfolio of equities and bonds. The expectation is that the bonds can help hedge a potential fall in equities. The usual 60/40 portfolio composed of equities and bonds might not be as successful in the future. The risk of shocks remains elevated and bonds may not provide a good enough buffer for those as the yields on nominal bonds are already close to the historical lows. A 60/40 portfolio is now a lot riskier with nominal bonds this expensive – nominal bonds offer a high risk in exchange for low potential returns.

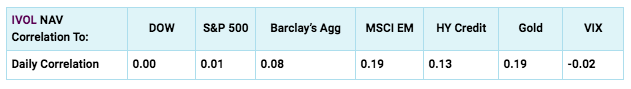

Investors will need to think outside the box and get into other assets other than just bonds and equities to get diversification. For example real estate, infrastructure and/or commodities. The IVOL ETF that I manage also has had low correlations to common asset classes, and has potential as a portfolio diversifier. IVOL has had very low correlations with common asset classes. In this environment, many investors are looking to add holdings which reduce the volatility of their portfolios. Investments with such low correlation coefficients can be very attractive to such investors:

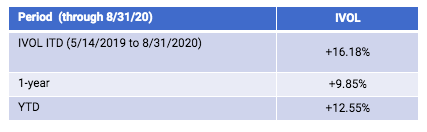

Here are a few of our highlights:

- Distributed at least 30bps monthly since July of 2019, which equates to a 3.6% annual distribution.

- Positive performance in Q1 (including March), Q2 and so far in Q3. Very few assets made money both during the Q1 panic and also during the Q2 recovery and Q3 rally

Daily correlation from 5/14/19 to 8/31/20. Source: Bloomberg and Quadratic calculations

For more information, visit https://www.ivoletf.com/.

Editor’s note: This article contains the opinion of the manager, and should not be regarded as investment advice.