A recent article in ETF.com offers Vanguard’s perspective on the history of active management and why it has a future.

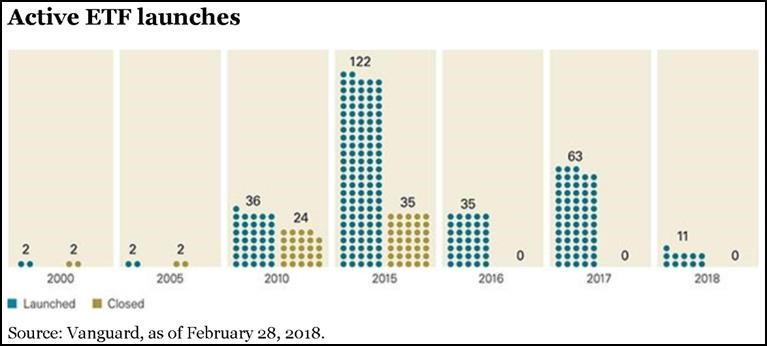

“Active management will survive, and maybe thrive, if it’s available at a low cost,” the article states, adding, “EFTs, then, offer an attractive vehicle.” The article argues that, since active ETFs emerged ten years ago, “it’s fair to say that investors have yet to adopt these investment vehicles the way they did their index-based counterparts.”

Issuers still hesitate to launch active ETFs, the article says, in part because of the SEC requirements to provide full disclosure of daily holdings. “Some issuers are concerned that this disclosure will prove harmful because it reveals proprietary alpha-generation techniques.” Many active issuers have since petitioned the SEC to allow “nontransparent ETFs,” but the only form to emerge has been a hybrid structure with features of both ETFs ad traditional mutual funds.

“As more active ETFs are placed on trading platforms,” the article says, “advisors may gravitate toward the potential advantages of building active portfolios for clients with low cost, transparent and tradeable ETFs. It concludes: “Broadly, we believe that active management has a future, but only if it’s delivered in low-cost products.”

Related: ClearShares Adds Alternative Bond ETF for Rising Rates

For more trends in fixed income, visit the Fixed Income Channel.