Newfound Research

Articles by Newfound Research

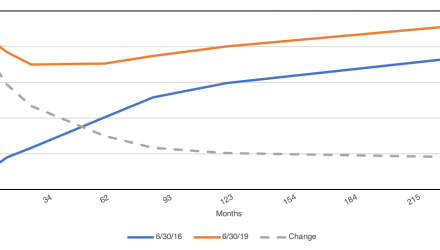

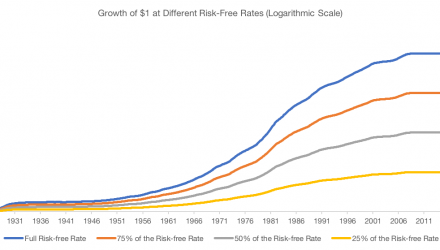

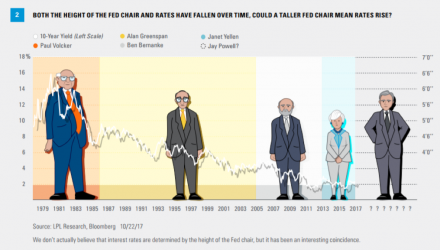

Heads I Win, Tails I Hedge

Summary For hedging strategies, there is often a trade-off between degree, certainty, and cost. Put options have high certainty and…

Tom Rosedale Co-Founder, CEO, CCO

Tom is Chief Executive Officer and Chief Compliance Officer of Newfound. Tom is also a co-founder of the company and has been an active employee since inception. Tom is responsible for oversight of Newfound’s business and operations, as well as various administrative functions. Tom is a member of Newfound’s Investment Committee and Compliance Committee, as well as serves on the Board of Newfound Investments, LLC, a joint venture with Virtus Investment Partners.

Prior to Newfound, Tom formed and operated a Boston-based boutique law firm (2002 – current) which currently employs seven lawyers – work is primarily representing public companies with SEC compliance and public and private offerings; venture capital financings (private placements); and M&A transactions. Prior to starting his law firm, Tom worked in-house at CMGI, Inc., and prior to CMGI was an associate at two large law firms.

Tom holds a B.S. (Finance), magna cum laude, Bryant University (1994), and a J.D., Boston University School of Law (1997).

Corey Hoffstein Co-Founder, CIO, CTO

Corey is a co-founder of Newfound Research and serves the roles of Chief Investment Officer and Chief Technology Officer. Corey researched and developed Newfound’s core momentum models that have been utilized to help power the tactical asset allocation decisions for over $10bn. Corey serves as chairman of the firm’s Investment Committee, is responsible for overseeing the Quantitative Strategies group, and serves as portfolio manager for the company’s investment strategies.

Corey also takes an active role in the management of the firm including directing business development and strategic growth initiatives.

Corey is a frequent contributor to ETF.com’s Strategist Corner and Forbes.com’s Great Speculations blog.

Corey holds a Master of Science in Computational Finance from Carnegie Mellon University and a Bachelor of Science in Computer Science, cum laude, from Cornell University.

Justin Sibears Managing Director, Portfolio Manager

Justin is a Managing Director in Newfound’s Investment Strategies group, where he is responsible for the ongoing research and development of new intellectual property and strategies. Justin joined Newfound in March 2012. His focus is on purely quantitative applications of our technology. Justin is critical in developing new business and client relationships. Justin is a portfolio manager for all of the firm’s direct strategies and is a member of Newfound’s Investment Committee.

Prior to Newfound, Justin worked for J.P. Morgan and Deutsche Bank. At J.P. Morgan, he structured and syndicated ABS transactions while also managing risk on a proprietary ABS portfolio. At Deutsche Bank, Justin worked on the event-driven, high-yield debt, and mortgage derivative trading desks.

Justin holds a Master of Science in Computational Finance and a Master of Business Administration from Carnegie Mellon University as a well as a BBA in Mathematics and Finance from the University of Notre Dame.