Although many investors are awaiting the big rebound, there are plenty of market opportunities for exchange traded fund (ETF) investors to get in on small daily dips.

In reality, two of the three major averages have not moved much over the month of April. According to Yahoo Finance, the tech-heavy NASDAQ has continued to rally, but the Dow Jones and S&P 500 have been mostly range-bound. The markets are not likely to have much direction or definition until earnings season has passed.

There is no reason for investors to wait on the sidelines, however, as the daily dips and curves that occur offer opportunity. We’ve also begun to see some movement in areas that have popped above their long-term trend lines.

Here are a few tips on how to choose the right stocks from some market pros:

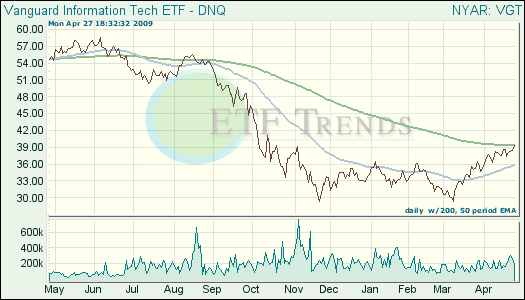

- Big tech names. By playing the big tech names, you are not exposed to the economic deterioration as much as many other sectors have seen. Tech does not have much debt and the it is leading the markets.

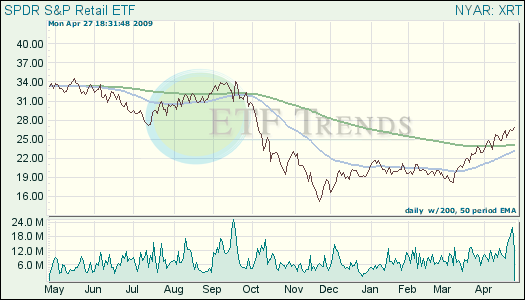

- Go retail shopping. The pressure of the economy is perfect for discount retailers and consumers worried about whether their jobs are safe are starting to avoid pricier stores and find ways to stretch their paychecks.

- Find the non-participants. While financials, the big tech names and consumer discretionary stocks have performed extremely well since the rally off the March lows, some of the market’s most reliable names have sat it out. Procter & Gamble (PG) is one such company.

- Restaurants. Certain restaurant chains are ready to ride out any economic pitfalls and have taken advantage of the economic conditions to benefit their positions. Also, look at those areas benefiting from consumers looking for cheap entertainment, such as Netflix (NFLX).

The markets are still not quite ready for a turn around as one of the basic foundations is still wrecked-the housing market. Housing prices are still falling and until the turnaround begins, be ready with a strategy. The 200-day moving average is a good signal, and by watching market trends you can be sure of your investment decisions.

- SPDR S&P Retail (XRT): up 29.9% year-to-date

- Vanguard Information Technology (VGT): up 14.6% year-to-date

- Consumer Discretionary Select Sector SPDR (XLY): up 4.2% year-to-date

For full disclosure, Tom Lydon’s clients own shares of XRT.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.