Spain is mired by a collapse in the construction sector and anincrease in joblessness could reduce the growth of its economy and subsequent exchange traded fund (ETF).

As the Spanish Central Bank calculates its economy, the 4th largest in the euro zone, predictions say it will contract 3% this year and consequently unemployment will climb to around 17%, as stated in MSN Money. GDP is also estimated to drop by 1% next year. Unemployment rates are currently around 15.5% and may reach 19.4% in 2010.

Government implemented tax cuts and emergency spending is projected to increase Spain’s public sector deficit to 8.3% of GDP in 2009 and 8.7% for 2010, reports Andrew Hay et. al. for Guardian.

Prime Minister Jose Luis Zapatero optimistically asserts the recession will turn around in the 2nd half of 2009; the Bank of Spain thinks it will happen in late 2010 with very low rates of growth.

In March, Spain’s inflation was down 0.1%, according to AFP. Annual inflation rates have been falling incrementally since a 5.3% high in July due to the economic downturn and to fall in oil prices.

Economy Minister Pedro Solbes calculates inflation will drop below 1% by July, and assures there is no risk of deflation, which can cause a cycle of diminished demand and increases in unemployment.

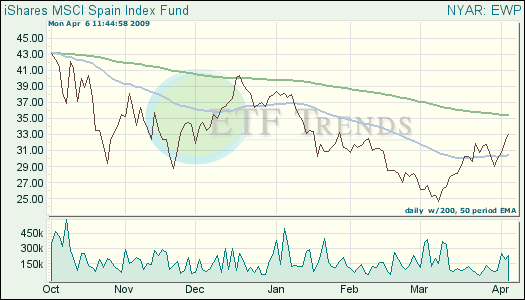

- iShares MSCI Spain Index (EWP): down 13.6% year-to-date

Max Chen contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.