Can the rally the markets and exchange traded funds (ETFs) saw on Monday – the fifth biggest one-day point gain in history – really continue?

On Monday, the Dow Jones Industrial Average went up a whopping 500 points. John Spence for MarketWatch reports that the unexpected increase in home sales for February helped to begin the rally.

The Treasury Department detailed a plan designed to help investors purchase $500 billion in so-called toxic assets remaining on bank balance sheets. The program will use $75 billion to $100 billion in capital from the Troubled Asset Relief Program, or TARP, and capital from private investors.

A question-and-answer from BBC News helps sort out some of the mystery about the plan:

- The plan will offer subsidies in the form of low-interest loans to private investors to encourage them to buy troubled mortgages and other loans from the banks. The government will back up the plan with cash.

- The Federal Reserve and the U.S. Treasury are paying for most of this plan, however, the private sector will be relied upon, as well.

- In the United Kingdom, the Bank of England will guarantee the banks against losses caused by their bad assets – for a hefty fee – but has not sought to purchase these assets directly.

- Yes, the United States already bailed out banks, but after a $700 billion bailout was approved, then-Treasury Secretary Henry Paulson opted to use the first $350 billion to directly buy stock in banks. Some of the remaining money will go to this new plan.

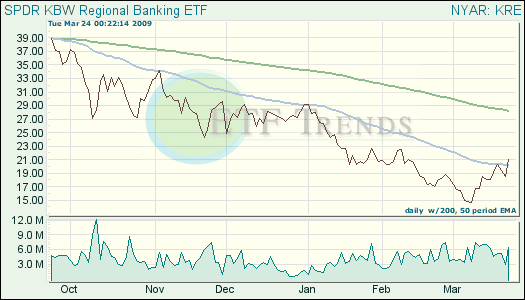

No one can say whether the rally on Monday will continue for certain, although the initial reaction to the plan was incredibly positive. Time will tell if the new plan works. In the meantime, mind those trend lines and wait for an uptrend.

- SPDR KBW Regional Banking (KRE): down 27.8% year-to-date; up 43.3% over the last two weeks

- Financial Select Sector SPDR (XLF): down 24.3% year-to-date; up 51.4% over the last two weeks

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.