Oil and gas demand has fallen of a cliff. As chants of “drill, baby, drill” fall away and the frenzy to find new oil fields recedes, many wonder what’s in store for these commodities and their exchange traded funds (ETFs).

Yes, reports Clifford Krause for The New York Times, the great American drilling boom has calmed down, as the number of oil and gas rigs deployed to tap new energy supplies across the country has plunged to less than 1,200 from 2,400 last summer. The falling prices of gas and oil are no longer giving companies the impetus for trying to squeeze as much out of the Earth as possible.

For the last four years, companies here drilled below airports, golf courses, churches and playgrounds in a frantic search for energy. They scoured the Rocky Mountains, the Great Plains, the Gulf of Mexico and Appalachia.

The economic downturn has led to a drilling downturn, however, the drop in prices has been appreciated by the U.S. consumer. This reversal of fortune may have a cyclical impact upon the industry, for consumer pricing and the ambition to rely less on foreign oil for energy resources. Energy experts and company executives warn that oil and gas companies now cutting back on investments will be unable to respond quickly to a future economic recovery. A turnaround, or glut, could rapidly turn to scarcity, sending energy prices soaring again.

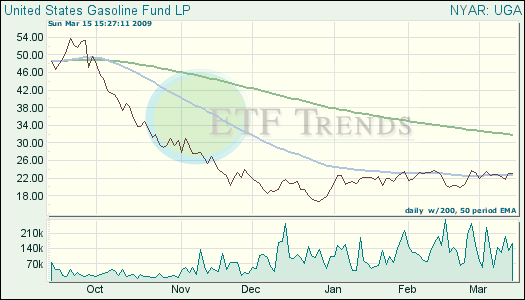

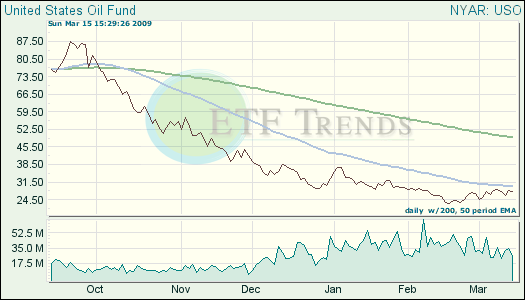

Where do we go from here? Mind the trend lines to see.

- United States Gasoline (UGA): up 18.5% year-to-date; up 0.70% for one week

- United States Oil (USO): down 27.5% year-to-date; down 1.3% for one week.

- iShares Dow Jones U.S. Oil & Gas Exploration (IEO): down 15.1% year-to-date; up 8% in the last week

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.