Unemployment in the United States is now at highs not seen since 1983, casting a grim shadow upon the economy and exchange traded funds (ETFs).

The unemployment rate surged to 8.1% in February as 651,000 jobs were cut. It’s just more proof of the deepening recession. Jeannine Aversa for the Associated Press reports that the job cuts are not likely to stop anytime soon, as employers are still cost-cutting and shrinking work forces as well as freezing wages and cutting pay.

As bad as it may be, many analysts say that that the worst is yet to come. The jobs downturn is the worst than any since The Great Depression, and the steepness of the decline makes it that much more difficult to recover, reports Chris Isodore for CNN Money. Over the last six months, 3.3 million jobs have been lost. That’s the largest six-month job loss since the end of World War II.

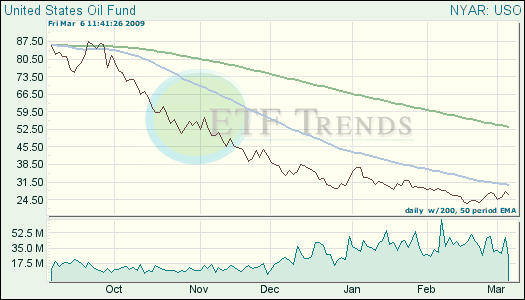

Oil prices are on the rise as the $44 mark has been passed, and this takes the prospect of falling gasoline prices off the table for consumers. Pablo Gorondi for the Associated Press reports the dollar weakness also helped boost oil prices, although gains were limited by news that the unemployment rates are soaring.

- United States Oil (USO): down 2.5% in the last week

Wells Fargo & Co. (WFC) is slashing dividend payouts in an effort to save the bank $5 billion annually. The San Francisco-based bank said it will cut its dividend to 5 cents from 34 cents. The next dividend is expected to be declared in April, according to Sara Lepro for the Associated Press. Although Wells Fargo has long been considered one of the stronger players in the banking sector, the company has recently faced increased scrutiny from analysts and investors who are worried about its capital levels.

Concern is mounting regarding the recent acquisition of Wachovia Corp. and losses it may have incurred because of this.

- SPDR KBW Bank (KBE): down 56.7% year-to-date; Wells Fargo is 9.2%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.