After a day in the markets like today, investors are undoubtedly wondering where the signs that point to a recovery might be lurking. When it comes to stabilizing the economy, which sectors and exchange traded funds (ETFs) must recover first: the financial system or the real estate market?

Federal Reserve Chairman Ben Bernanke thinks the stabilization of the financial system is the most important sector that will ultimately lead us out of the recession. Bernanke suggested that a recovery in other sectors will stem from financial stabilization. Senators singled out housing as an area for concern, but the chairman insisted that the focus must be on the wider economy, reports The Wall Street Journal.

If confidence is restored, then the recovery will lead to a mending of the housing market. The chicken-or-the-egg question comes to mind, as one of the key sticking points keeping banks under pressure has been the toxic assets weighing on balance sheets. Many of these assets are based on home loans.

While the chairman holds to the side of the financial market leading us out of this mess, he does not undermine the importance of the housing market as a key indicator of the health of the economy.

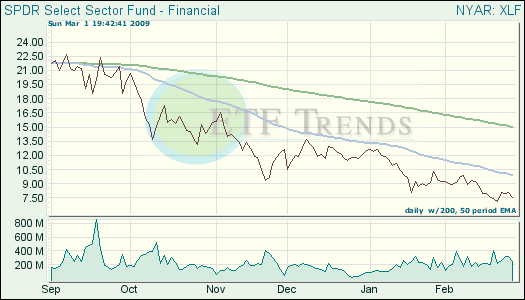

- Financial Select Sector SPDR (XLF): down 39.3% year-to-date

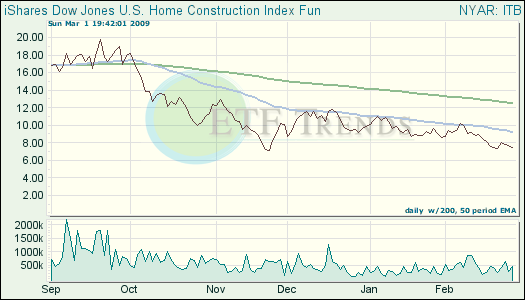

- iShares Dow Jones U.S. Home Construction (ITB): down 24.3% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.