A period of deflation in the U.S. economy sometime soon is feared, but there is an exchange traded fund (ETF) that can help you when the deflationary period reverses itself.

Consumer prices are likely to keep slumping this year and into next, but we can’t keep deflating forever. Some managers feel that the best time to insure yourself against inflation is now, when you don’t even need it. Jonathon Burton for The Wall Street Journal gives us reasons that the TIPs bond fund can give you the decent inflation insurance.

- TIPs 101. Treasury Inflation-Protected Securities help you maintain the purchasing power of your dollar even as inflation takes it away. TIPS offer a fixed yield plus the inflation rate to keep pace with changes in the consumer price index

- Why now? With the market focused on deflation, the inflation insurance that TIPS provide is cheap. And smart shoppers know the best time to buy insurance is when you don’t need it.

- Using ETFs. TIPS may be attractive, and many financial advisers recommend a permanent 15% portfolio allocation to the class, but buying these bonds at periodic Treasury auctions or in the secondary market can be a pain. An ETF made up of TIPS is easier and more cost efficient.

For a TIPS-focused ETF, have a look at:

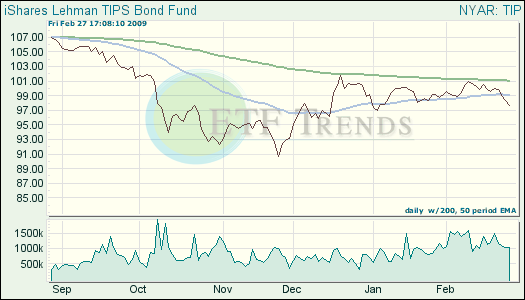

- iShares Barclays TIPS Bond (TIP): up 5.1% over three months; down 2% over one week

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.