Has the mother of all oil exchange traded funds (ETFs), the United States Oil Fund(USO), morphed into a size that is too big for the average investors to incorporate into their portfolios?

USO is a $3.3 billion ETF and as of Friday, the fund rolled all of its positions over for the next month, leading some to believe that it’s sending tremors through the futures markets. Carolyn Cui for The Wall Street Journal highlights some important ways USO is showing how strong it has become:

- Size matters: the size of USO represents 22% of the outstanding front-month contracts, sending waves through the futures markets.

- Price dips: The fund is said to have contributed to oil’s dip below $40 a barrel on Friday; crude oil trading volume was double the average volume posted so far this year on Friday.

- Too big to hide: Since late last year, the fund has more than tripled in size, following a $3.46 billion net inflow in December and January. Billions of dollars are pouring into this ETF, as investors bet that the price of oil has bottomed.

However, industry sources tell ETF Trends that it might not be so cut-and-dry and that it’s actually too soon to tell whether USO is impacting oil prices on its own or is working in conjunction with other forces in the marketplace. Aside from the rolled-over positions, there’s a widening spread that suggests oil prices have more to do with weak demand and growing inventories, along with Friday’s unemployment report showing that another 600,000 people are out of work.

Sources say that the spread has been rising for two weeks, and so far today hasn’t gone back to where it was on Friday. If it continues to widen, it could suggest more than just USO’s size is at play.

Eventually, oil prices should see some sense of normalcy restored. At the moment, demand continues to plummet and production levels are still higher than the rate of use. This situation has led to the price of the front month lagging the further out month. Sources suggest that what could probably happen is that cuts will continue coming until they’re below demand, but this could take another month or two.

As of Monday, the price of oil is lingering above $40 per barrel, as investors speculate on the rescue package, and the banks’ rescue plan in the Unted States. The high numbers in unemployment are simply not supporting a spike in oil demand, reports Carlo Piviano for the Associated Press.

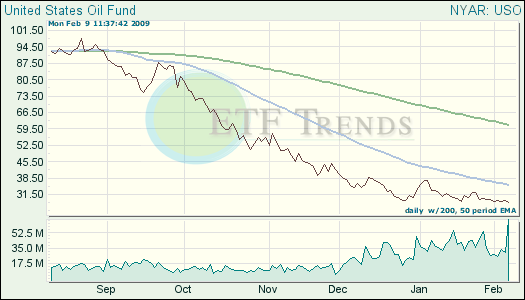

- United States Oil (USO) down 43.8% over past three months; down 14.8% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.