Clean energy may not be seeing the sunnier side of the pasture, as the one-time rally from the introduction of the Obama administration isn’t enough to sustain the sector, planned projects and related exchange traded funds (ETFs).

Development Halted. The plummeting economy and the frozen credit markets has made it nearly impossible for green-minded companies to move forward with installation, development and implementation. Rather, installation for solar and wind-powered projects has halted and plunged, as the latest factories and developments have announced layoffs and cutbacks, explains Kate Galbrath for The New York Times.

After all, talk is nice, but it’s going to take real cash to really get things moving.

Banks Behind Troubles. Trade groups have projected a 30-50% decline in installation of new equipment, largely because the ailing banks behind the financing end of the growth. At one time, around 18 banks were willing to finance the projects, especially with the new promise of President Barack Obama’s administration. They would help finance installation of wind turbines and solar arrays, taking advantage of generous federal tax incentives. Since then, the number of banks able to back the projects has dropped to four.

Both wind and solar power are baking on the new stimulus package to get things off the ground again, but time is a cruel element that will have its way first. For the meantime, related companies are bracing for a slowdown.

Anticipating Brighter Days. Some people are thinking ahead, though. Case in point: the L.A. Unified School District is offering an adult training program to prepare people to meet the expected demand when such projects get going, says Adolfo Guzman-Lopez for KPCC Radio. The construction program amounts to $20 billion.

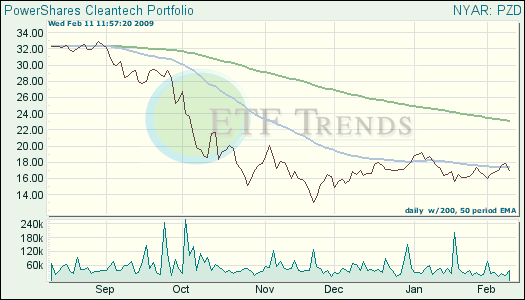

- PowerShares Cleantech Portfolio (PZD): down 6.4% year-to-date

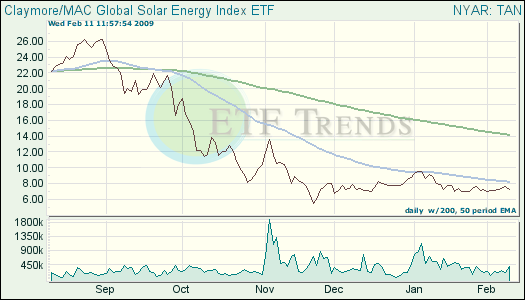

- Claymore Global Solar Energy ETF (TAN): down 17.8% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.