Oil has been trading around $40 a barrel now for about two weeks, which has some analysts making predictions about where the commodity and its related exchange traded funds (ETFs) are headed next.

Oil hit a four-year low of $32.40 a barrel on Dec. 19, and has since rebounded more than 20%, says Moming Zhou for MarketWatch. Since then, it has occasionally fallen below $40, but for the last two weeks, it has closed above that point.

This has analysts expecting a bottom, but what oil does next depends on two factors that often work against one another:

- OPEC production cuts: The organization is eyeing its most recent cuts to see whether more are needed when it meets again on March 15. They want to see prices around $60 a barrel.

- The weakening global economy: Falling consumer demand and spending is expected to continue. If OPEC’s cuts raise prices, people can’t be expected to spend much. Most energy agencies predict that global oil demand will fall by 1% to 2% this year.

Oil trading in the first few months of the year didn’t bode well for those bullish on oil – it’s down about 13% from the start of 2009. Analysts predict that oil prices could decline as low as $25 in the second quarter.

While these questions remain about what oil is going to do in the coming weeks and months, the best thing to do is sit back and watch the trendlines while these forces battle it out.

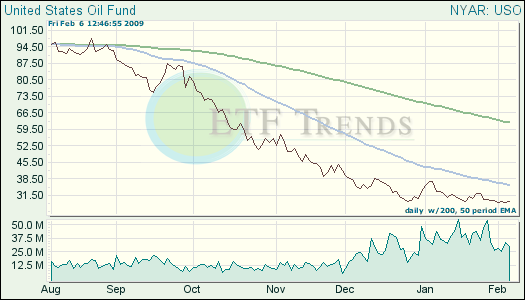

United States Oil (USO): down 10% in the last month

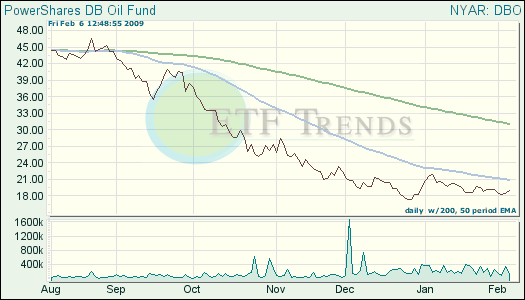

PowerShares DB Oil Fund (DBO): down 12.5% in the last month

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.