Goldman Sachs has raised the outlook for gold’s price to $1,000, giving rise to a new record for holdings in exchange traded funds (ETFs). Safe haven buying seems to be the trend in response to the mixed economic news, but has the ship sailed?

Analysts differ in their opinions on that. Some say the big shock waves in the economy have already occurred, and the big rush to gold is over, says Ali Hussain for the Times Online. On the other hand, there are analysts who say that gold’s value is still relatively high and will retain its value, even if the bankking system collapses.

Record holdings have been seen in the SPDR Gold Shares (GLD) which is the largest gold-backed ETF in the world. Lewa Pardomuan for Mineweb reports that gold was trading at $902.85 an ounce last week. It was last March when the precious metal hit a record $1,030 an ounce.

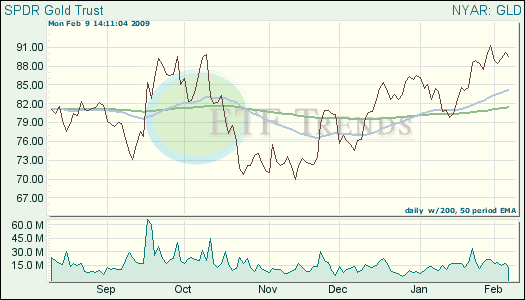

Whatever happens with gold, you can’t fight the trend. Right now, GLD is above both its 50-day and 200-day moving averages. This is why we have an exit strategy – when a fund goes below its trend line or falls 8% off the recent high, we sell.

- SPDR Gold Shares (GLD) up 3.4% over one month; up 18.2% over past three months.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.