India is facing a long road ahead of it, as corporate transparency has become an issue that has hindered the growth of its markets, stocks and exchange traded funds (ETFs).

Shareholders that control Indian companies will soon be required to disclose when they put up stock holdings as backups to collect against a loan. Uday Khandeparkar for The Wall Street Journal reports that the Satyam Computer Systems founder Ramalinga Raju was able to perpetrate a massive fraud, in part by raising as much as $250 million in undisclosed borrowings against stock he owned.

Had these borrowings been made public, investors and regulators would have been clued into the corruption taking place in front of their eyes. It should be noted that pledging stock as collateral is not uncommon.

Speculation for disclosure will go forward in two ways:

- In an effort to arrange financing, company founders have been offering their stock up as collateral for corporate borrowings.

- Controlling families have borrowed against existing stocks holdings to pay for personal expenses.

Mandatory disclosures are due to come to fruition in a few weeks, and investors are going to reassess their risks in current investments.

Meanwhile, President Pratibha Patil called for more corporate governance this weekend, and pushed to address unethical practices by some firms that have resulted in shareholder losses, reports the Hindu.

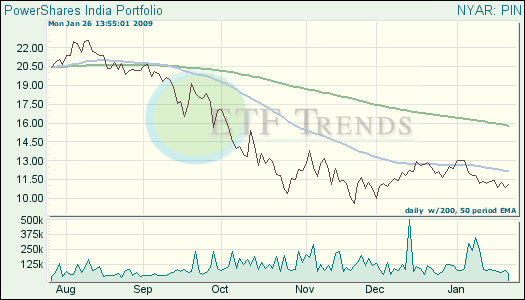

- PowerShares India (PIN): down 8.5% over past three months

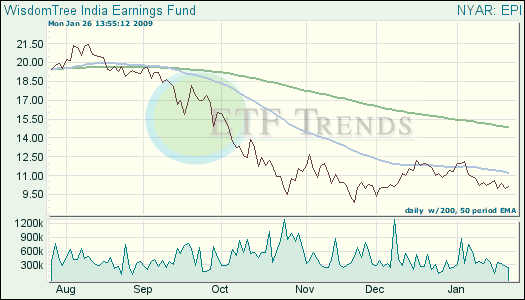

- WisdomTree India Earnings (EPI): down 7.7% over past three months

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.