Consumer confidence is at all-time lows, retail sales are slumping, and stores are slashing prices up to 90% off, so what goods and services are still selling amid the hold up, and which exchange traded funds(ETFs) are set to profit?

For December 2008, retail sales were down 2.7%, however, $343.2 billion was the total amount reported in retail sales for the month. Lauren Sherman for Forbes investigates what it is consumers are still buying and what is actually selling for full price.

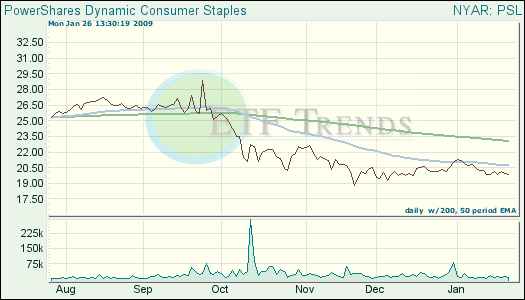

- Personal care/hygiene. Items ranging from toothpaste, soap and toilet paper just are not dispensable, and the same goes for shampoo, and skin care gift sets whose sales lifted from November 2007 through November 2008 up 11-18%. PowerShares Dynamic Consumer Staples (PSL) holds companies such as Colgate-Palmolive (CL), and Sysco (SYY).

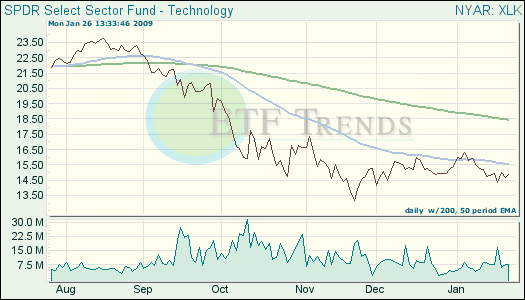

- Technology as an escape. Buying products that can relieve the stress of the slowdown, such as tech related products, are like a mind vacation. Video games have sprouted up 14% in sales, while SmartPhones sales have also increased. Mini-laptops are also a constant, especially with an affordable $300 price tag. Technology Select Sector SPDR (XLK) holds companies ranging from Apple (APPL) to eBay (EBAY) and AT&T (T).

- Gyms/Health Clubs. Despite the economic slowdown, it seems people do not want to let themselves go, which is good news. Health is important and many understand there is no price tag to looking and feeling your best despite how the economy is doing. Most will either keep their same plan or simply downgrade memebership, rather than cancel. How about a health and fitness ETF?

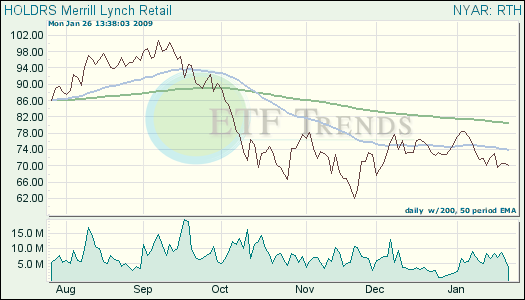

- Toys. The toy building sets like Legos saw sales shoot up 12%, and not only do these toys last a childhood, they keep them occupied for hours. Target (TGT) and Wal-Mart (WMT) have sizeable toy departments, and are holdings in the Retail HOLDRs (RTH).

- Car Maintenace Wiper blades, spark plugs or brakes – you name it, everyone who owns a car still needs it, eventually.

- Dress casual shoes. The types of shoes that can convert from the office to the weekend saw sales growth at 0.3% from November 07 to November 08. Their versatility is key.

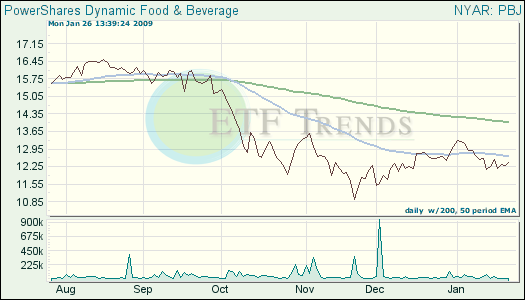

- Restaurants. The type of eateries that offer cheap and convenient ways for the entire family to eat will continue their success. Four stars and above are seeing declining sales, though. PowerShares Dynamic Food & Beverage (PBJ) could reap the reweards.

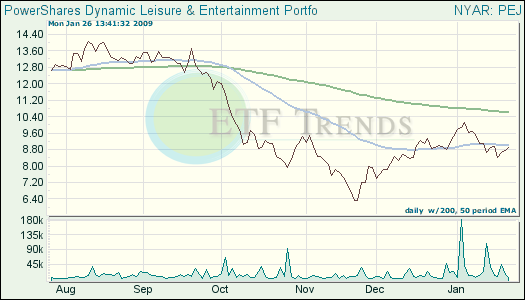

- Movie Tickets. The sales in the category saw a decrease of 5% in 2008, theaters actually made a 2% increase in sales from 2007. Although tickets can range from $15-$20 a person, the movies are still a cheap form of entertainment. PowerShares Dynamic Leisure and Entertainment Portfolio (PEJ) could benefit.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.