Earnings reports are on most investors’ minds this week, as they are continuing to unveil, and help project some type of market sentiment for stocks and exchange traded funds(ETFs) to follow.

Heavies Apple (APPL) and EBay (EBAY) are anticipated later today, while BlackRock, Inc. (BLK), and Coach, Inc. (COH) have reported their numbers.

U.S. Bancorp (USB) has reported their profit as well, and profit is down to levels not seen since 2001. As one of the 10 largest U.S. banks, the disappointing numbers show that the credit crunch have even hurt the most conservative of lenders, reports Jonathon Stempel for Associated Press.

One bright spot is IBM (IBM), which beat expectations with fiscal fourth-quarter profit of $4.4 billion. Its yearly forecast also handily surpassed expectations, reports Carla Mozee for MarketWatch.

Along the same sentiment, both American Airlines (AMR) and United, UAL Corporation (UAUA), have posted losses as of Wednesday. United’s parent corporation has reported a loss at $1.3 billion for the fourth quarter, blamed on operating costs and fuel prices, which turned bets sour as oil prices fell. The Associated Press explains that witout the bad hedges, results beat analysts’ expectations.

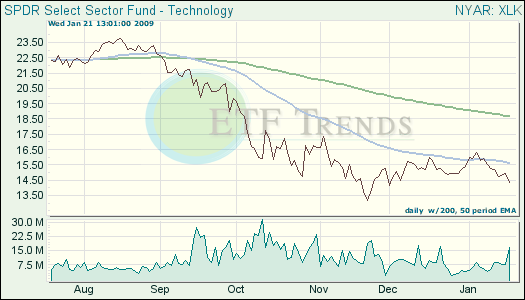

- Technology Select Sector SPDR (XLK): down 6.2% in the last month; IBM is 7.5%

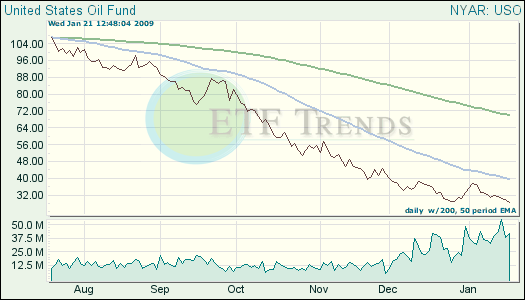

The U.S. crude supply continues to grow, causing oil prices to tick upward, and stuffing any gains made upon Wall Street. Light, sweet crude for March delivery is trading around $41 a barrel midday.

- United States Oil (USO): down 10% for one week

Behind the scenes, the Timothy F. Geithner confirmation hearing is going to take place today. President Barack Obama’s choice for Treasury secretary is testifying before the Senate Finance Committee reagrding his failure to pay $34,000 or so in taxes for Social Security and Medicare when he was a senior official at the International Monetary Fund from 2001 to 2003, along with a small portion in 2004.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.